What Is Risk Management?

Risk management is one of the most important topics you will ever read about trading.

Why is it important? Well, we are in the business of making money, and in order to make money we have to learn how to manage risk (potential losses).

Ironically, this is one of the most overlooked areas in trading. Many forex traders are just anxious to get right into trading with no regard for their total account size.

They simply determine how much they can stomach to lose in a single trade and hit the “trade” button. There’s a term for this type of investing….it’s called…

GAMBLING!

When you trade without risk management rules, you are in fact gambling.

You are not looking at the long term return on your investment. Instead, you are only looking for that “jackpot.”

Risk management rules will not only protect you, but they can make you very profitable in the long run. If you don’t believe us, and you think that “gambling” is the way to get rich, then consider this example:

People go to Las Vegas all the time to gamble their money in hopes of winning a big jackpot, and in fact, many people do win.

So how in the world are casinos still making money if many individuals are winning jackpots?

The answer is that while even though people win jackpots, in the long run, casinos are still profitable because they rake in more money from the people that don’t win. That is where the term “the house always wins” comes from.

The truth is that casinos are just very rich statisticians. They know that in the long run, they will be the ones making the money–not the gamblers.

Even if Joe Schmoe wins a $100,000 jackpot in a slot machine, the casinos know that there will be hundreds of other gamblers who WON’T win that jackpot and the money will go right back in their pockets.

This is a classic example of how statisticians make money over gamblers. Even though both lose money, the statistician, or casino in this case, knows how to control its losses. Essentially, this is how risk management works. If you learn how to control your losses, you will have a chance at being profitable.

In the end, forex trading is a numbers game, meaning you have to tilt every little factor in your favor as much as you can. In casinos, the house edge is sometimes only 5% above that of the player. But that 5% is the difference between being a winner and being a loser.

You want to be the rich statistician and NOT the gambler because, in the long run, you want to “always be the winner.”

So how do you become this rich statistician instead of a loser? Keep reading!

什么是风险管理?

这一章节的课程,是你读过的所有关交易知识的课程中,最重要的章节之一。

为什么它那么的重要?这是因为,我们是在经营一盘赚钱的生意,为了能在交易中赚钱,我们必须学会怎样管理风险(潜在的亏损)。

非常讽刺的是,风险管理也是在交易中,最容易被忽视的领域之一。许多交易者们都是迫不及待地投入到交易中,却根本没有考虑到他们账户的资金总规模。

他们只是简单草率的判断了,自己在一笔的交易中,能承受多大的亏损,然后就毫不犹豫的按下“买卖”的按钮。对于这种类型的投资方式,有一个术语 。。。它就称为。。。

赌博!

当你在没有遵守资金管理的规则下进行交易活动,你实际上就等同于无脑的赌博行为,因为职业的赌徒是非常精于资金管理的。

你根本完全不在乎,你投资项目的长期回报。相反的,你只是专注在那“满堂红头奖”。

货币管理规则不仅只是保护你,同时还长期的让你有利可图。如果你不相信我们说的话,并且认为“无脑赌博”才是发财致富的途径,那么深思一下这个例子:

人们总是去Las Vegas的赌场赌钱,并希望不用动脑筋,就能赢个满堂红大头奖,而实际上,确实是有很多人都赢了。

既然那么多的人都中了大头奖,但是全世界的赌场为什么还是能赚钱呢?

答案就是:即使让人们中了累积的大奖,但从长远来看,赌场仍然是有利可图。因为他们可以迅速而又大量地,从没有中奖的人那里获得更多的钱。这就是为什么有句术语“庄家永远是赢家”的由来了。

事实的真相是,赌场的老板们都是些,非常有钱的统计学家。他们知道,从长远来看,他们是赚钱的一方,而不是那些赌徒们。

即使一位Joe Schmoe在吃角子老虎机上赢得了 $100,000的累积大奖,赌场们也确信在这时候,一定会有几百个其他的赌徒不会赢得大奖。最后,钱自然又会回到赌场的口袋中。

这是一个关于统计学家,如何通过赌徒们来赚钱的经典例子。即使双方同时一起输钱,该统计学家们,或是赌场在这样的情况下,也知道如何控制他们的损失,以保留胜利的种子。从本质上讲,这就是资金管理所起的作用。如果你学会了怎样控制你的亏损,那么你将会学会,如何扩大你的盈利。

说到最后,外汇交易也是一种数字游戏,这意味着你必须让所有的,有利于你的因素,尽可能的倾向你。在赌场中,庄家比玩家占有的优势,有时只有5%而已。但是,这个5%正是一个胜利者和失败者之间的区别。

你应该要成为一个精于概率论的富有统计学家而 不是 一个无脑主义的赌徒。因为只要长期的交易下来,你就会成为“永远的赢家”。

那么,你要怎样才能成为有钱的统计员,而不是一个失败者呢?

How Much Trading Capital Do You Need For Forex Trading?

It takes money to make money. You need trading capital. Everyone knows that, but how much does one need to get started in forex trading? The answer largely depends on how you are going to approach your new start-up business.

First, consider how you are going to be educated. There are many different approaches in learning how to trade: classes, mentors, on your own, or any combination of the three.

While there are many classes and mentors out there willing to teach forex trading, most will charge a fee. The benefit of this route is that a well-taught class or great mentor can significantly shorten your learning curve and get you on your way to profitability in a much shorter amount of time compared to doing everything yourself.

The downside is the upfront cost for these programs, which can range from a few hundred to a few thousand dollars, depending on which program you go with. For many of those new to trading, the resources (money) required to purchase these programs are not available.

For those of you unable or unwilling to pony up the cash for education, the good news is that most of the information you need to get started can be found for FREE on the internet through forums, brokers, articles and websites like BabyPips.com. We should all thank Al Gore for inventing the Internet. Without him, there would be no BabyPips.com.

As long as you are disciplined and laser-focused on learning the markets, your chances of success increase exponentially. You have to be a gung ho student. If not, you’ll end up in the poor house.

Second, is your approach to the markets going to require special tools such as news feeds or charting software? As a technical forex trader, most of the charting packages that come with your broker’s trading platform are sufficient (and some are actually quite good).

For those who need special indicators or better functionality, higher-end charting software can start at around $100 per month.

Maybe you’re a fundamental trader and you need the news the millisecond it is released, or even before it happens (wouldn’t that be nice!).

Well, instantaneous and accurate news feeds run from a few hundred to a few thousand dollars per month. Again, you can get a complimentary news feed from your forex broker, but for some, that extra second or two can be the difference between a profitable or unprofitable trade.

Finally, you need money/capital/funds to trade. Retail forex brokers offer minimum account deposits as low as $25, but that doesn’t mean you should enter immediately! This is a capitalization mistake, which often leads to failure. Losses are part of the game, and you need to have enough capital to weather these losses.

So how much trading capital do you need? Let’s be honest here, if you’re consistent and you practice proper risk management techniques, then you can probably start off with $50k to $100k in trading capital.

It’s common knowledge that most businesses fail due to undercapitalization, which is especially true in the forex trading business.

So if you are unable to start with a large amount of trading capital that you can afford to lose, be patient, save up and learn to trade the right way until you are financially ready.

开始正式交易的资本

赚钱是需要本钱的。每个人都知道这句话,但是需要多少钱才能开始交易的活动呢?答案很大的程度上,取决于你准备怎样着手开始这新生意。

第一件是,考虑你将用什么方式来学习。现在有很多不同的途径,来学习如何做生意:上课、找导师、自学,或是将三者结合起来。

虽然有很多课程和导师乐于教导外汇的交易知识,但大部分都是收费的。这条路的好处是:有一个高质量的课程或是伟大的良师,可以显著缩短你学习的周期,让你掌握赚钱盈利的技能,这比起你自己亲力亲为所花的时间,相对更短。

但这种方式的弊端就是,你需要为这些课程,提前支付几百到几千元不等,这取决于你要参加哪一项的课程。对许多交易新手来说,他们没有必要为这些课程,白白耗费掉资源(现金)。

对于你们一些不能或不愿意为上课掏钱的,好消息就是在起步阶段时,所需要的所有信息资料,都能透过论坛、经纪商、文章,和像BabyPips这样的网站免费获得。我们都应该感谢Al Gore副总统创造了互联网。没有他,也就不会有BabyPips。

只要你自律的钻研有关市场的知识,你获得成功的几率就会稳步增加。你要做一个全力以赴的学生。否则,你将会在破烂的房子里终了一生。

第二件是,你切入市场的途径,是否需要即时的新闻消息或绘图软件?作为一个技术分析交易者,大多数你的经纪商交易平台上,已经提供了很充分的绘图软件包(而且有一些实际上是相当的不错)。

对于一些需要特别的指标,或更好功能的人,高端的绘图软件,由每月$100左右起。

可能你是一个基本分析的交易者,所以你可能需要最快的速度,获得最新发布的新闻数据,甚至是在它发生之前(可以这样该多好啊!)

嗯,即时和准确的新闻消息,从每月的数百到数千美元不等。同样的,你可以从你的经纪商那,获得免费的新闻提要。但对一些人来说,得到信息的快慢,不是一两秒钟之间的差别,而是赚钱还是亏本的分别。

最后,你需要金钱/资金/基金来进行交易活动。散户至少要有$25的存款,但这并不意味着你就应该马上加入。这是一个投资的错误运用,常常会导致失败。亏失也是交易的一部分,所以你需要足够的资金来承担这些亏失。

那么你到底需要多少资金呢?让我们坦白地告诉你,如果你能保持坚持,并实践正确的资金管理技术,那么你也许可以用$50k至$100k的资金,来开始正式的交易。

众所周知,大多数生意上的失败,都归结于资金不足,在外汇交易的生意上,这更是一个真理。

因此,如果你没有足够的钱来承担亏失,那就耐心点,慢慢积累资金,并学习正确的交易方法,直到你的经济已经准备妥当。

Drawdown and Maximum Drawdown Explained

So we know that risk management will make us money in the long run, but now we’d like to show you the other side of things. What would happen if you didn’t use risk management rules?

Consider this example:

Let’s say you have a $100,000 and you lose $50,000. What percentage of your account have you lost?

The answer is 50%.

Simple enough.

This is what traders call a drawdown.

A drawdown is the reduction of one’s capital after a series of losing trades. This is normally calculated by getting the difference between a relative peak in capital minus a relative trough. Traders normally note this down as a percentage of their trading account.

Losing Streak

In trading, we are always looking for an edge. That is the whole reason why traders develop systems. A trading system that is 70% profitable sounds like a very good edge to have. But just because your trading system is 70% profitable, does that mean for every 100 trades you make, you will win 7 out of every 10?

Not necessarily! How do you know which 70 out of those 100 trades will be winners?

The answer is that you don’t. You could lose the first 30 trades in a row and win the remaining 70. That would still give you a 70% profitable system, but you have to ask yourself, “Would you still be in the game if you lost 30 trades in a row?”

This is why risk management is so important. No matter what system you use, you will eventually have a losing streak. Even professional poker players who make their living through poker go through horrible losing streaks, and yet they still end up profitable.

The reason is that the good poker players practice risk management because they know that they will not win every tournament they play. Instead, they only risk a small percentage of their total bankroll so that they can survive those losing streaks.

This is what you must do as a trader. Drawdowns are part of trading. The key to being a successful forex trader is coming up with trading plan that enables you to withstand these periods of large losses. And part of your trading plan is having risk management rules in place.

Only risk a small percentage of your “trading bankroll” so that you can survive your losing streaks. Remember that if you practice strict money management rules, you will become the casino and in the long run, “you will always win.”

In the next section, we will illustrate what happens when you use proper risk management and when you don’t.

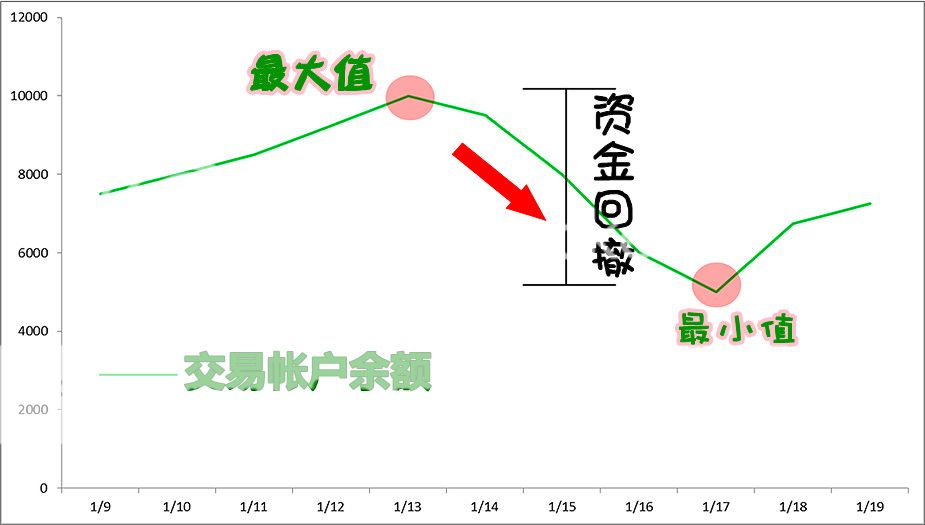

资金回撤和最大跌幅

既然我们已经知道了,资金管理能使我们的长期的交易中赚取利润。但现在,我们将向你们展示另外一种情况。如果你没有遵守资金管理的规则,将会发生什么事?

思考下面这个例子:

假设你有$100,000,然后你亏了$50,000。那么你亏损了账户的多少百分比呢?

答案是50%。

一个非常简单的问题。

这就是交易者们所说的资金回撤。

资金回撤是指,在经过一连串的失败交易之后,交易者资金减少的程度。这通常是通过计算,自己资本的最大值和最小值之间的差异,所得到的结果。交易者们通常会将资金回撤的数额,以百分比的形式记录在交易账目上。

一连串的失败

在交易时,我们一直在寻找一种优势。这也是交易者们,致力于发展各种交易系统的主要原因。一个赢率高达70%的交易系统,听上去像是拥有了不错的优势。但是你的系统,即使是拥有了70%的赢率,难道就代表你交易的100笔单子中,可以每交易10笔都赢得7笔吗?

那可不一定哟!你怎么知道100笔的交易中,是哪70笔将会赢利呢?

答案是:你根本没法知道,那70笔是分布在哪里。你可能会在开始的前三十笔交易中连续亏损,然后在接下来的70笔中实现赢利。这仍然是个可以为你赢利70%的系统,但你需要问问你自己,“如果连续亏损了30次之后,你还能活下来,继续玩这个游戏吗?

这就是为什么资金管理是非常重要的原因。无论你使用的是什么样的系统,终究都会遇到连续的亏损。即使是以扑克牌为生的职业扑克玩家,在经历了可怕的连续亏损之后,他们还是能赚钱的。

主要的原因就是,优秀的扑克牌玩家,都拥有完善的资金管理方法,因为他们知道自己不可能把把都赢。所以他们只承担,自己总资金的一个很小百分比亏损,这样他们就能在一连串的亏损中活下来,并取得最后的胜利。

这些是你作为交易者所必须遵守的。资金回撤是交易中的一部分。想成为一名成功的交易者,主要的关键是遵守一个能使您,抵御一连串亏损的交易计划。确保你的交易计划,已经让风险管理就位了。

只是使用您的“交易资金”中,很小的一部分来冒险,你才能在一连串的亏损中幸存下来。记住这点,如果你严格的实行资金管理规则,你将会成为像赌场老板那样的人,从长期来看,“你将永远是一个赢家。”

在下一个课程里,我们将会举例说明,当你运用适当的资金管理时,会出现什么效果,不用的话又会怎样。

Never Risk More Than 2% Per Trade

How much should you risk per trade?

Great question. Try to limit your risk to 2% per trade.

But that might even be a little high. Especially if you’re newbie forex trader.

Here is an important illustration that will show you the difference between risking a small percentage of your capital per trade compared to risking a higher percentage.

Trader Risks 2% vs. 10% Per Trade

| Trade # | Total Account | 2% risk on each trade | Trade # | Total Account | 10% risk on each trade |

|---|---|---|---|---|---|

| 1 | $20,000 | $400 | 1 | $20,000 | $2,000 |

| 2 | $19,600 | $392 | 2 | $18,000 | $1,800 |

| 3 | $19,208 | $384 | 3 | $16,200 | $1,620 |

| 4 | $18,824 | $376 | 4 | $14,580 | $1,458 |

| 5 | $18,447 | $369 | 5 | $13,122 | $1,312 |

| 6 | $18,078 | $362 | 6 | $11,810 | $1,181 |

| 7 | $17,717 | $354 | 7 | $10,629 | $1,063 |

| 8 | $17,363 | $347 | 8 | $9,566 | $957 |

| 9 | $17,015 | $340 | 9 | $8,609 | $861 |

| 10 | $16,675 | $333 | 10 | $7,748 | $775 |

| 11 | $16,341 | $327 | 11 | $6,974 | $697 |

| 12 | $16,015 | $320 | 12 | $6,276 | $628 |

| 13 | $15,694 | $314 | 13 | $5,649 | $565 |

| 14 | $15,380 | $308 | 14 | $5,084 | $508 |

| 15 | $15,073 | $301 | 15 | $4,575 | $458 |

| 16 | $14,771 | $295 | 16 | $4,118 | $412 |

| 17 | $14,476 | $290 | 17 | $3,706 | $371 |

| 18 | $14,186 | $284 | 18 | $3,335 | $334 |

| 19 | $13,903 | $278 | 19 | $3,002 | $300 |

You can see that there is a big difference between risking 2% of your account compared to risking 10% of your account on a single trade!

If you happened to go through a losing streak and lost only 19 trades in a row, you would’ve went from starting with $20,000 to having only $3,002 left if you risked 10% on each trade.

You would’ve lost over 85% of your account!

If you risked only 2% you would’ve still had $13,903 which is only a 30% loss of your total account.

Of course, the last thing we want to do is to lose 19 trades in a row, but even if you only lost 5 trades in a row, look at the difference between risking 2% and 10%. If you risked 2% you would still have $18,447. If you risked 10% you would only have $13,122. That’s less than what you would’ve had even if you lost all 19 trades and risked only 2% of your account!

The point of this illustration is that you want to setup your risk management rules so that when you do have a drawdown period, you will still have enough capital to stay in the game.

Can you imagine if you lost 85% of your account?!!

You would have to make 566% on what you are left with in order to get back to break even!

Trust us, you do NOT want to be in that position. You’d start looking a lot like Cyclopip. Do you wanna look like Cyclopip? Didn’t think so!

Here is a chart that will illustrate what percentage you would have to make to breakeven if you were to lose a certain percentage of your account.

| Loss of Capital | % Required to get back to breakeven |

|---|---|

| 10% | 11% |

| 20% | 25% |

| 30% | 43% |

| 40% | 67% |

| 50% | 100% |

| 60% | 150% |

| 70% | 233% |

| 80% | 400% |

| 90% | 900% |

You can see that the more you lose, the harder it is to make it back to your original account size. This is all the more reason that you should do everything you can to PROTECT your account.

By now, we hope you have gotten it drilled in your head that you should only risk a small percentage of your account per trade so that you can survive your losing streaks and also to avoid a large drawdown in your account.

Remember, you want to be the casino… NOT the gambler!

不要亏得连裤子都要当掉

这里有个简短的图解,它将向您展示,当你使用资金的比例,比较小或比较大来冒险时,两者之间的差异。

当每笔交易所冒的风险为:2%的风险 VS. 10%的风险

交易 序号 # | 账户净值 | 每笔交易 承担2%的风险 | 交易 序号# | 账户净值 | 每笔交易 承担10%的风险 |

1 | $20,000 | $400 | 1 | $20,000 | $2,000 |

2 | $19,600 | $392 | 2 | $18,000 | $1,800 |

3 | $19,208 | $384 | 3 | $16,200 | $1,620 |

4 | $18,824 | $376 | 4 | $14,580 | $1,458 |

5 | $18,447 | $369 | 5 | $13,122 | $1,312 |

6 | $18,078 | $362 | 6 | $11,810 | $1,181 |

7 | $17,717 | $354 | 7 | $10,629 | $1,063 |

8 | $17,363 | $347 | 8 | $9,566 | $957 |

9 | $17,015 | $340 | 9 | $8,609 | $861 |

10 | $16,675 | $333 | 10 | $7,748 | $775 |

11 | $16,341 | $327 | 11 | $6,974 | $697 |

12 | $16,015 | $320 | 12 | $6,276 | $628 |

13 | $15,694 | $314 | 13 | $5,649 | $565 |

14 | $15,380 | $308 | 14 | $5,084 | $508 |

15 | $15,073 | $301 | 15 | $4,575 | $458 |

16 | $14,771 | $295 | 16 | $4,118 | $412 |

17 | $14,476 | $290 | 17 | $3,706 | $371 |

18 | $14,186 | $284 | 18 | $3,335 | $334 |

19 | $13,903 | $278 | 19 | $3,002 | $300 |

你可以看到,每笔交易如果使用,2%来冒险和使用10%来冒险,两者会对你的账户产生明显的分别。一开始时的 $20,000,在你很不幸的经历了,连续19次的交易亏损后,如果你一开始是采用10%来冒险,那你将仅剩$3,002,亏掉了你账户中超过85%的资金!而如果你一开始是采用2%来冒险的话,那你的账户在经历了上述的不幸情况后,还留下$13,903,这只是亏掉了你账户资金的30%左右!

当然,我们尽量避免的情况,是出现连续19次的亏损。但如果你只是连续5次的亏损,那我们再来看一看,冒2%的风险和冒10%的风险,会有什么的的区别。如果你只是冒着2%的风险,你仍然有$18,447。而如果你是冒着10%的风险,你将会剩下$13,122。这个余额数目,比你使用2%的资金,再连续亏损19次后的余额还少!

上面的图解要告诉你的是,要设置好你的资金管理规则,这样当你经历一段资金回撤的时期后,你仍然有足够的资本可以在游戏中继续玩。

你能想像,当你失去了账户的85%资金后,是什么情况吗?

你将必须赚取到566%,才能回复到亏损85%之前的初始账户资金。而刚亏损了85%的你,有信心可以赚回566%吗?

相信我们,你绝对不希望处于这种情况的。

这有一张图表,描述当你一旦亏损了,特点的百分比之后,要回复到你亏损前的原始资金,所需要赚取的百分比。

资本亏损的比例 | 回到原始资金 所需要赚回的 % |

10% | 11% |

20% | 25% |

30% | 43% |

40% | 67% |

50% | 100% |

60% | 150% |

70% | 233% |

80% | 400% |

90% | 900% |

你可以从上面的图表中发现,当你亏损得越多,在你要赚回原始资本的时候,你面临的难度就越大。这就是为什么你应该尽你所能,作最大的努力来保护你账户资金的原因。

从现在开始,我们希望你把上面的道理,牢牢的烙印在你的脑袋里。就是每一笔冒险的交易,永远只占你账户资金的很小百分比。这样即使你不幸的出现连续亏损,你也能活下来;同时避免了太大的回撤,在您的帐户中出现。记住,你是想成为一位精明的赌场老板…而不是无脑主义的赌徒!

Reward-to-Risk Ratio

Another way you can increase your chances of profitability is to trade when you have the potential to make 3 times more than you are risking. If you give yourself a 3:1 reward-to-risk ratio, you have a significantly greater chance of ending up profitable in the long run.

Take a look at this chart as an example:

| 10 Trades | Loss | Win |

|---|---|---|

| 1 | $1,000 | |

| 2 | $3,000 | |

| 3 | $1,000 | |

| 4 | $3,000 | |

| 5 | $1,000 | |

| 6 | $3,000 | |

| 7 | $1,000 | |

| 8 | $3,000 | |

| 9 | $1,000 | |

| 10 | $3,000 | |

| Total | $5,000 | $15,000 |

In this example, you can see that even if you only won 50% of your trades, you would still make a profit of $10,000. Just remember that whenever you trade with a good risk to reward ratio, your chances of being profitable are much greater even if you have a lower win percentage.

BUT…

And this is a big one, like Jennifer Lopez’s behind… setting large reward-to-risk ratio comes at a price. On the very surface, the concept of putting a high reward-to-risk ratio sounds good, but think about how it applies in actual trade scenarios.

Let’s say you are a scalper and you only wish to risk 3 pips. Using a 3:1 reward to risk ratio, this means you need to get 9 pips. Right off the bat, the odds are against you because you have to pay the spread.

If your broker offered a 2 pip spread on EUR/USD, you’ll have to gain 11 pips instead, forcing you to take a difficult 4:1 reward to risk ratio. Considering the exchange rate of EUR/USD could move 3 pips up and down within a few seconds, you would be stopped out faster than you can say “Uncle!”

If you were to reduce your position size, then you could widen your stop to maintain your desired reward/risk ratio. Now, if you increased the pips you wanted to risk to 50, you would need to gain 153 pips. By doing this, you are able to bring your reward-to-risk ratio somewhere nearer to your desired 3:1. Not so bad anymore, right?

In the real world, reward-to-risk ratios aren’t set in stone. They must be adjusted depending on the time frame, trading environment, and your entry/exit points. A position trade could have a reward-to-risk ratio as high as 10:1 while a scalper could go for as little as 0.7:1.

If you want a real world example of traders trying to maximize reward-to-risk ratios, you should check out Pipcrawler’s Pick of the Day blog and Cyclopip’s Weekly Winner. Pipcrawler normally takes trade setups that have at least 2:1 ratios, while Cyclopip pinpoints the best setups from the previous week that would have maximized his profits.

报酬对风险的比率(RRR)

另一种你可以用来提高盈利的方式,就是只有在当你觉得,潜在的报酬率大于风险3倍的情况下才进行交易。如果你给自己预设的风险回报比是3:1,那么你在经过长期的交易中,明显拥有很大的优势。看看下面这个图表的例子:

| 十笔交易 | 损失 | 获利 |

| 1 | $1,000 | |

| 2 | $3,000 | |

| 3 | $1,000 | |

| 4 | $3,000 | |

| 5 | $1,000 | |

| 6 | $3,000 | |

| 7 | $1,000 | |

| 8 | $3,000 | |

| 9 | $1,000 | |

| 10 | $3,000 | |

| 总数 | $5,000 | $15,000 |

在这个例子中,你可以看见即使你的胜率只有50%,你仍然可以挣得$10,000的利润。只需要记得,无论你什么时候想要进行交易,只要具有良好的风险回报比例,即使你的胜率较低,你也拥有获得高盈利的交易优势。

但是……

而且是一个很大的“但是”,像拉丁天后Jennifer Lopez的屁股一样。。。设立高的RRR是要付出代价的。从非常的表面上看,一个高回报的风险比的概念听起来确实不错,但想一想该如何把它应用于实际的交易情况下。

让我们假设你是个剥头皮交易者,你只是想冒险3个点的风险。如果使用3:1的回报风险比,这意味着你需要获得9个点。从一开始,机会就对你不利,因为你还需要支付差价。

如果你的经纪商在欧元/美元提出的差价是2点,那你现在最少需要要获利11个点,这间接迫使你采用1:4的风险回报比例。只要细想下欧元/美元的汇率,就知道随时都会在短短的几秒内,上下波动个3点。这会快到让你在还没来得及,呼叫“当铺的老板”前,就直接被踢出游戏来。

如果你想要缩小你的头寸,那么你可以扩大你的目标,来维持你想要的风险回报比。现在,如果你想将冒险的点数增加到50个点,那你就需要预设获利153个点。这样做的话,你就能够将你的风险回报比,维持在接近你所期望的3:1。还不错呗,不是吗?

在现实中,风险回报比不是一成不变的。它们需要依据于时间框架、市场环境,和你进场/出场的位置,来进行调节的。一个持仓交易可以有高达10:1的风险回报率,而剥头皮交易却是少得可怜的0.7:1。

Summary Of Risk Management

Be the casino, not the gambler!

Remember, casinos are just very rich statisticians!

It takes money to make money. Everyone knows that, but how much does one need to get started in trading? The answer largely depends on how you are going to approach your new trading business. It varies person to person.

Drawdowns are a reality and WILL happen to you at some point.

The more you lose, the harder it is to make it back to your original account size. This is all the more reason that you should do everything you can to protect your account.

We hope that it’s been drilled into your head that you should only risk a small percentage of your account on each trade so that you can survive your losing streaks and also to avoid a large drawdown in your account.

The less you risk on a trade, the less your maximum drawdown will be. The more you lose in your account, the harder it is to make it back to breakeven.

This means you should only trade only a small percentage of your account. The smaller the better.

Less is more.

2% or less is recommended.

“2% or less” per trade is a highly recommended guideline for everyone to follow. We stress “guideline” because it depends on other factors besides your experience like your trading system–mainly how often it takes a trade.

The more currency trades you take per timeframe that your focus on, the less you want to risk per trade. Also, don’t forget to factor in changing market volatility and any adjustments to your entries and exits.

总结:风险管理

成为“赌场老板”,而不是“赌徒”!

记住,赌场老板们都只是很有钱的精明统计学家!

我们需要资金才能够赚钱。人人都知道这一点,但是,多少钱才能开始进行交易呢?答案很大程度上取决于你要如何开始你的新生意。这是见仁见智的。

资金回撤是现实的,而且在某个时候 说不定 就发生在你的身上了。

你亏损的越多,就越难的赚回到,亏损前的原始资金水平。这就是你需要竭尽所能,保护你账户资金的唯一最重要原因。

我们希望你能把这样的观念,牢牢地印在你的脑海里:你只能冒很小的风险,这样才能在连续的亏损中得以存活下来。要尽量避免一个大回撤发生在你的账户中。

在交易时,你冒的风险越小,你亏失的就越少。你账户亏损得越多,它就越难回到亏损前的水平。

这就是说,你应该只用账户总额的,一小部分来进行交易,越少越好。

少 也能变成 多

推荐只用2%,或更少的资金冒险。

虽然使用高风险回报比(RRR)来进行交易,是理想可取的方法,但它也是有缺陷的。在现实的市场里,风险回报比不能一成不变。

风险回报比都是可以调节的,这取决于交易的时间框架、市场状况和你进场/出场的位置。