What is a Currency Cross Pair?

Back in the ancient days, if someone wanted to change currencies, they would first have to convert their currencies into U.S. dollars,

and only then could they convert their dollars into the currency they desired.

into U.S. dollars, and then convert these dollars into yen.

With the invention of currency crosses, individuals can now bypass the process of converting their currencies into US dollars and

simply convert it directly into their desired currency. Some examples of crosses include: GBP/JPY, EUR/JPY, EUR/CHF, and EUR/GBP.

Calculating Currency Cross Rates

Warning: This part is a little boring…unless you like numbers. It’s not difficult but it can be kind of dry. The good news is

that this section really isn’t necessary anymore since most broker platforms already calculate cross rates for you.

However, if you are the type that likes to know how everything works, then this section is for you! And besides, it’s always good to

know how things work right? In this section, we will show you how to calculate the bid (buying price) and ask (selling price) of a

currency cross.

Let’s say we want to find the bid/ask price for GBP/JPY. The first thing we would do is look at the bid/ask price for both GBP/USD and

USD/JPY.

Why these 2 pairs?

Because both of them have the U.S. dollar as their common denominator.

These 2 pairs are called the “legs” of GBP/JPY because they are the U.S. dollar pairs associated with it.

Now let’s say we find the following bid/ask prices:

GBP/USD: 1.5630 (bid) / 1.5635 (ask)

USD/JPY: 89.38 (bid) / 89.43 (ask)

To calculate the bid price for GBP/JPY, you simply multiply the bid prices for GBP/USD and USD/JPY.

If you got 139.70, good job! Your calculator is working properly, yipee!

To get the ask price for GBP/JPY, just multiply the ask prices for GBP/USD and USD/JPY and we get 139.82. Easy as pie!

什么是货币的交叉配对?

“货币的交叉配对”,也称为”交叉货币对”,或干脆简称为”交叉盘”。它是指一组,不涉及美元的货币对。

回到远古的时代,如果有人想要兑换货币,他们首先得要将本国的货币兑换成美元,然后他们才能把手上的美元,转换成他们想要的货币。

举个例子,如果一个人想把手中的英镑兑换成日元,他们首先要做的是把英镑兑换成美元,然后才将这些美元兑换成日元。

随着货币交叉盘的发明,个人现在可以绕过,把本国货币兑换成美元这个复杂的过程,只需简单直接就可以兑换成自己所需的货币。一些交叉盘的例子:英镑/日元,欧元/日元,欧元/瑞郎,和欧元/英镑等。

交叉汇率的计算

…… 除非你是喜欢数字的。但这段内容并不困难,只是它很枯燥。好消息是,这部分其实并不是非常重要,因为大多数经纪商的交易平台,已经为您计算好交叉的汇率了。

但是,如果你是那种喜欢清楚一切如何运作的人,那么这部分是为你准备的!而且,清楚知道事情是如何运作的,总是有益的,对吧?在本节课中,我们将展示给你,如何计算在一个交叉货币对的投标价(买进价),和询问价(卖出价)。

假设我们要查找英镑/日元的买进/卖出的价格,首先我们会做的是,查看英镑/美元和美元/日元,两种货币的买进/卖出价格。

为什么是这2种货币对?

因为它们两对都有一个共同的货币:美元。

这两对货币也被称为英镑/日元的”腿”,因为是由它们通过美元而组成英镑/日元的。

现在我们来看看下面的买进/卖出价:

英镑/美元:1.5630(买进价)/ 1.5635(卖出价)

美元/日元:89.38 (买进价)/ 89.43(卖出价)

为了计算出英镑/日元的买进价,你只需要直接的把英镑/美元,和美元/日元的买进价相乘就可以了。

如果你得到139.70,做得很好!您的计算器操作正常,耶!

要得到英镑/日元的卖出价,同样只需要把英镑/美元,和美元/日元的卖出价格相乘,我们就得到139.82。小菜一碟!

Why Trade Currency Crosses?

Over 90% of the transactions in the forex market involve the U.S. dollar. This is because the U.S. dollar is the reserve currency in

the world. You may be asking yourself, “Why the U.S. dollar and not the sterling, or euro?”

Most agricultural and industrial commodities such as oil are priced in U.S. dollars. If a country needs to purchase oil or other

agricultural goods, it would first have to change its currency into U.S. dollars before being able to buy the goods. This is why many

countries keep a reserve of U.S. dollars on hand. They can make purchases much faster with Greenbacks already in their pocket.

Countries such as China, Japan, and Australia are examples of heavy importers of oil, and as a result, they keep huge reserves of U.S. dollars

in their central banks. In fact, China has almost a trillion U.S. dollars in its reserve stockpile!

So what does this all have to do with trading currency crosses? Well since most of the world is glued to the U.S. dollar, a majority of

trading speculation will be based on one question:

“Is the U.S. dollar weak or strong today?”

This one question will affect many of the most liquid currency pairs:

The majors: GBP/USD, EUR/USD, USD/CHF, USD/JPY

The commodity pairs: AUD/USD, USD/CAD, NZD/USD

Notice that all of these pairs are tied to the U.S. dollar. This doesn’t give a trader many options when most of their trading

decisions are based on this one speculation.

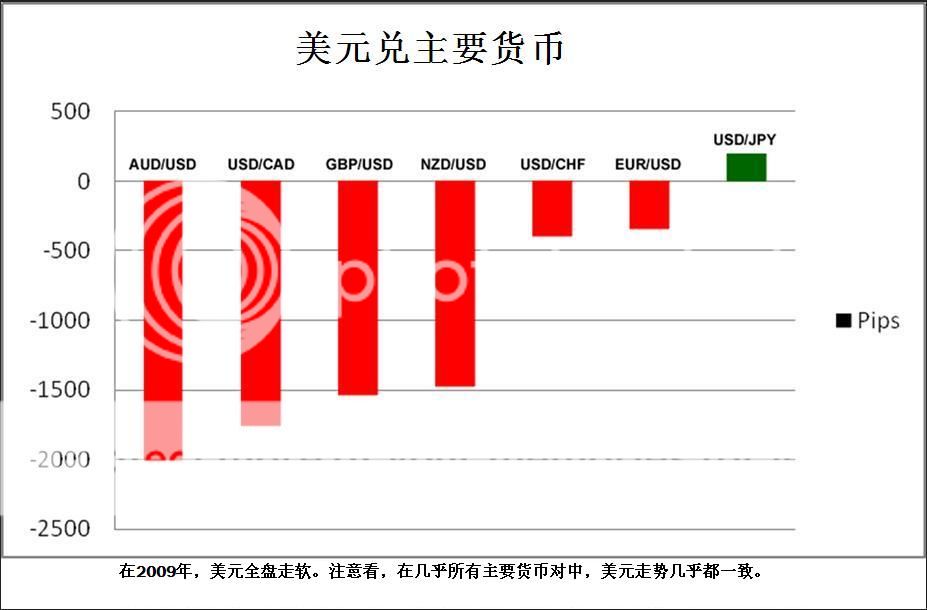

You can see that by trading any of the 7 most popular currencies, you are basically taking either an anti-U.S. dollar or pro-U.S.

dollar stance. This one speculation affects these pairs in almost the same way across the board.

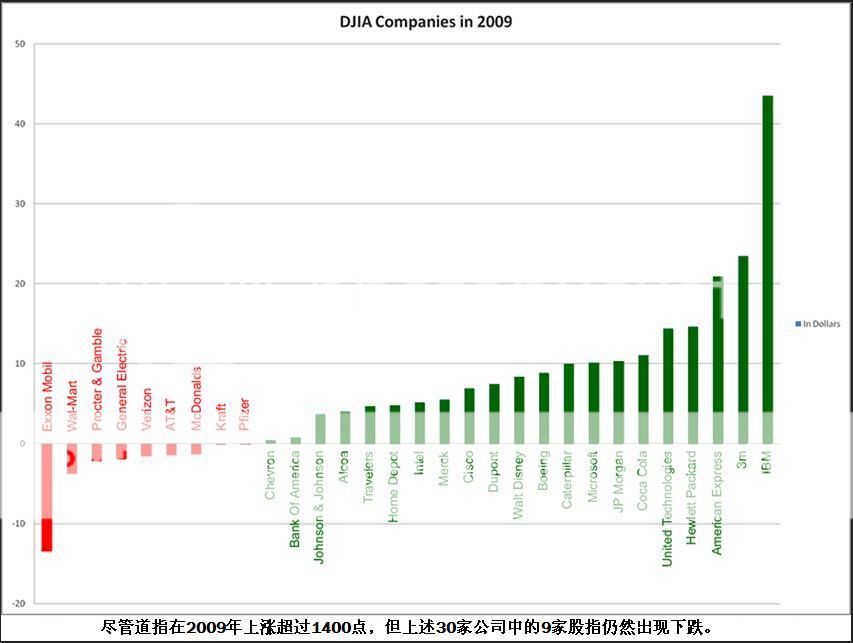

Conversely in the stock market, traders have multiple companies to choose from and are not bound to one major speculation idea.

With stocks, you can see that even though the overall market was positive, there are still plenty of other trading opportunities. There

isn’t just one kind of speculation that affects the entire basket of stocks.

Currency Crosses Provide More Trading Opportunities

Instead of just looking at the seven “major” dollar-based pairs, currency crosses provide more currency pairs for you to find

profitable opportunities!

By trading currency crosses, you give yourself more options for trading opportunities because these currencies are not bound to the

U.S. dollar, thus possibly having different price movement behaviors. So while the majority of the markets will only trade on anti-U.S.

dollar or pro-U.S. dollar sentiments, you can find new opportunities in currency crosses.

Just check out Cyclopip’s

Currency Cross-Eyed blog and you’d realize that crosses present a huge potential for catching plenty of pips!

For example, all the dollar-based pairs might be trading sideways or in some uglier fashion where it would be smart to just sit on the

sidelines and wait for better trade setups, but if you knew to switch your charts to look at currency crosses, you might just find trading

opportunities galore!

Be different! The majority of traders just trade the majors. Now you can be part of the minority that

trade currency crosses.

交叉货币对提供更多交易机会

外汇市场中超过90%的交易都涉及到美元。这是因为美元是全球储备货币。你可能会问自己:”为什么全球储备货币是美元而不是英镑或欧元呢?”

大多数农产品和工业商品,诸如石油都是以美元计价的。如果某一国需要购买石油或其他农产品,在购买相关产品之前,它首先需要将该国货币兑换成美元。这也是绝大多数国家将美元作为其外汇储备的原因所在。只要他们口袋中有美元,他们购买国外其他商品就会更加的便捷。

中国、日本以及澳大利亚等国都是主要的石油进口国,因此,这些国家央行都储存有规模绝大的美元外汇储备。事实上,中国目前的外汇储备量已超3.3万亿美元。

那么,我们为什么还要交易交叉货币对呢?鉴于美元主导了全球货币体系,绝大多数投机交易都基于这一问题:

“今天美元是走强了,还是走软了呢?

这一问题将直接影响到绝大多数最具流动性的货币对:

主要货币对:欧元/美元、英镑/美元、美元/日元、美元/瑞郎

商品货币对:澳元/美元、美元/加元、纽元/美元

注意看,所有这些货币对都是和美元有联系的。当交易者的大部分交易决定都是基于美元的变动时,他们的交易选择机会会很少。

你可以看到,交易7大主要货币对,你的立场基本上都看涨美元,或者看跌美元。对美元单一品种的投机使得7大货币对通常出现同涨同跌的情况。

而反观股市,你可以看到,尽管总体市场走势积极,你仍有众多其他的交易机会。对一种品种的投机并不会影响到整个股票市场。

和7大主要货币对紧盯美元走势不同,交叉货币对为外汇交易者提供了更多的获利机会!

通过交易交叉货币对,你对交易将会具有更多选择,因为这些货币对并不和美元产生直接关系,因此,它们可能出现不同的走势特征。因此,尽管市场总体情绪是看涨或看跌美元,你仍能在交叉货币对上找到新的交易机会。

比如说,所有美元直盘在一些时候可能维持横盘整理态势,而此时,交易者最好的选择莫过于离场观望,以待捕捉新的交易机会;但是,如果你将目光转向交叉盘,你将看到众多的交易机会!

大多数交易者你交易主要货币对,现在,你可以加入到少数派阵营中,选择交易交叉货币对。

Currency Crosses Are Trend-y

Since a majority of the forex market will deal with the U.S. dollar, you can imagine that many of the news reports will cause U.S.

dollar-based currency pairs to spike. The US has the largest economy in the world, and as a result, speculators react strongly to U.S.

news reports, even if it doesn’t cause a huge fundamental shift in the long run.

What this means for your charts is that you will see several “spikes” even if there is a trend emerging. This can make it harder to

spot trend or range indications.

The day to day economic activities of the U.S. can keep U.S. dollar based currencies such as EUR/USD (above) from making smooth

trends.

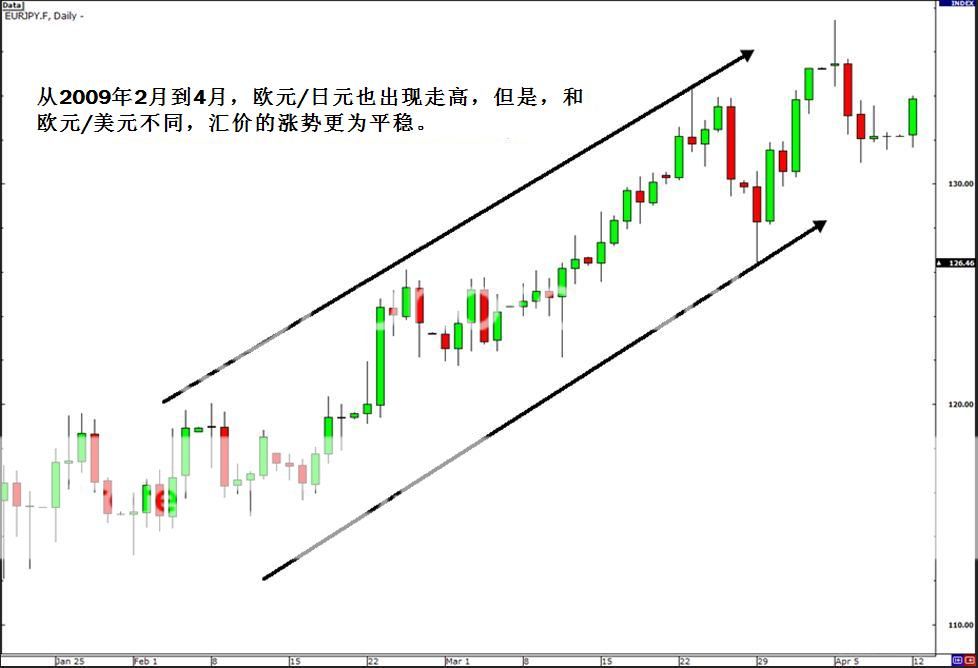

Conversely, we can see that during the same date range, cross currency EUR/JPY made a much, much smoother ride to the top. This was

probably due to less spikes that came from U.S. data. So as you can see, both charts showed the euro rise during the same time period, but

the one without the U.S. dollar (EUR/JPY) made for a much easier trade.

Our resident currency cross monster Cyclopip caught a hundred pips by riding EUR/JPY’s trend. Check out how caught that move!

If you are a trend following kinda dude, then currency crosses may be easier to trade than the major pairs. It will be easier for you

to spot the trend and be more confident in your entry points because you know that these technical levels hold more than they do for

the majors.

In the next section, we’ll discuss how playing with currency crosses can also allow you to take advantage of the interest rate

differentials. Now that’s like a cherry on top of a sundae!

交叉货币对的优势

由于外汇市场绝大多数货币对都涉及到美元,所以绝大多数报告或数据的公布都有可能导致美元相关货币对的剧烈变动。美国具有全球最大的经济体,因此,投机者会对美国所公布的报告作出强烈反应,尽管从长期来看,报告数据并不会显示美国基本面状况的改变。

这意味着,即使涉及到美元的货币对表现出趋势的初步走势,但是在趋势进程中,仍有可能出现一些剧烈波动的情况。这使得交易者难以识别,汇价到底是会走出趋势行情,还是维持区间波动。

美国方面频繁公布的经济数据使得和美元相关的货币对,诸如上图中的欧元/美元难以出现平稳的趋势走势。

与之相对的是,我们看到在相同的时间框架下,欧元/日元的上升趋势更为平稳。这很可能是因为汇价避免了因美国方面数据所引发的剧烈波动行情。

所以,你可以看到,上述两个图形都显示欧元在同期出现上升行情,但是不涉及到美元的货币对(欧元/日元)的上升趋势更加的明显。

如果你是一名趋势跟随者,那么,交叉货币对较美元直盘要更容易把握。交叉货币对的趋势行情更容易识别,交易者设置入场点位也会更加自信,因为你知道,交叉货币对的这些技术点位较直盘更为稳定。

在下课中,我们将讨论,利用利差交易交叉货币对。

Trade Interest Rate Differentials

By selling currencies whose country has a lower interest rate against currencies whose country has a higher interest rate, you can

profit from the interest rate differential (known as a carry trade) as well as price appreciation.

That’s like being able to get a frosted cupcake with sprinkles on top! That talks to you! Imagine how delicious that would taste!

Currency crosses offer many pairs with high interest rate differentials that are prime for these types of trades.

For example, take a look at the nice uptrend on AUD/JPY. If you had a long position on this pair, you would’ve made a hefty profit.

On top of that, the interest rate differential between AUD and JPY was huge. From 2002 to 2007, the Reserve Bank of Australia had raised rates

to 6.25% while the BOJ kept their rates at 0%.

That means you made profits off your long position AND the interest rate differential on that trade!

Now that’d be an awesome cash cow right there!

called risk aversion. But that’s for a later lesson.

利用利差进行交易

卖出低利率国家货币兑高利率国家货币,你可以通过利差以及汇率的变动而获利。

这就好像你获得了一块上面点缀了零星小糖果的纸杯蛋糕!它在向你问候呢!想象一下,品尝它的滋味是不是特别的美味。

交叉货币对中,有一些货币对具有较高的利差,这些货币对适宜进行套息交易。

让我们看看澳元/日元的完美上升趋势。如果你持有澳元/日元多头,你的获利将是非常可观的。

值得注意的是,澳元和日元之间的利差非常巨大。从2002年到2007年,澳洲联储累计将基准利率升至6.25%,而日本央行一直维持利率在近零水平。

这意味着,你可以同时从做多澳元/日元以及澳元和日元的利差中获利。

现在,这可是一头巨大的现金牛!

在随后的大学课程中,我们将教你更多有关套息交易的知识,当然,学习这些课程的前提是你的头没有因为学习到如此多的外汇知识而爆炸。我们也将教你有关风险规避的内容,但是,这是稍后课程将讲解的。

Be Careful Trading Obscure Currency Crosses

While the euro and yen crosses are the most liquid crosses, more currency crosses exist that don’t even include the U.S. dollar, euro,

or the yen! We’ll call these the “Obscure Currency Crosses”!

If we were in school – come to think of it, we actually are in school! – the major pairs would be the jocks while the obscure currency

crosses would be the eccentric emo kids or hipsters.

We’re talking about really weird combinations like AUD/CHF, AUD/NZD, CAD/CHF, and

GBP/CHF. That’s why we call them obscure crosses (duh!).

Trading in these pairs can be more difficult and riskier than trading euro or yen currency crosses. Since very few forex traders trade

them, transaction volume is much lower resulting in lower liquidity.

Due to the illiquid markets for these crosses, their prices can become quite volatile, so being stopped out on

whipsaws can become a common occurrence.

Check out these screenshots of AUD/CHF and GBP/CHF:

You don’t want to get stopped out by those nasty spikes, do you? That’s why most forex traders usually put wider stops when trading

these pairs.

But judging from the choppy movement of obscure crosses, it would really be tough to catch a good trade on these pairs. Unless you’re a

currency cross guru like Cyclopip, of course!

See what we mean?

Also, since these currency cross pairs aren’t traded too much by forex traders, the spreads on these pairs can be pretty big.

If you want to trade these currency crosses, just be ready for some wild price swings and be willing to pay the price of the massive

spread!

非 常见交叉货币对

尽管欧元和日元交叉货币对是最具流动性的交叉货币对,但是,绝大多数交叉货币对并不包含欧元或日元。我们将这些货币对称作”非常见交叉货币对”。

如果我们在学校–稍等,我们实际上就是在学校!主要货币对就好比那些受人关注的优等生,而不常见的交叉货币对则好比那些着奇装异服的问题少年。

那是因为,绝大多数交易者更愿意交易这些流动性较好的交叉货币对,而非这些不常见的交叉货币对。

不常见的交叉货币对诸如:澳元/瑞郎、澳元/纽元、加元/瑞郎以及英镑/瑞郎。

交易这些不常见的交叉货币对更为困难,且风险性也较欧元或日元等交叉货币对更大。由于只有极少数交易者会交易这些货币对,交易量会非常少,且市场流动性也会非常之低。

由于这些交叉货币对的流动性不足,它们的汇率波动性会非常的大,所有交易者会经常被打止损。

让我们来看看澳元/瑞郎以及英镑/瑞郎的例子。

你可不想被突然的波动而止损出局,是吧?这也是为什么绝大多数交易者在交易这些货币对是,会设置较宽的止损原因所在。

由于不常见交叉货币对的走势波动性过于频繁,交易者进行此类货币对的交易会显得非常困难。除非你极度热衷于此类货币对交易,那另当别论。

知道我们的意思了吗?

同时,由于这些货币对并不经常用来交易,因此交易这些货币对的点差会非常的大。

如果你打算交易这些货币对,对于非常有可能出现的剧烈价格波动,以及将要支付的高昂点差费用,得事先做好心理准备。

How to Trade Fundamentals With Currency Crosses

If strong economic data comes out of Australia, you might want to look at buying the AUD. Your first reaction might be to buy

AUD/USD.

But what if at the same time, recent data also show the United States experiencing strong economic growth? Price action of AUD/USD may

be flat.

One option that you have is to match the AUD against the currency of an economy that isn’t doing so well…. Hmmmm… what

could you do?

Ah! Thank the forex gods for currency crosses!

Let’s say you did some analysis, checked the BabyPips.com economic calendar (shameless plug!) or Pip Diddy’s daily economic roundup (another shameless plug!) and you notice that the Japanese economy isn’t doing

so good right now.

What do you do?

Of course, like any self-respecting bully, you jump all over this opportunity and go long AUD/JPY!

It’s your job as a forex trader to take advantage of certain opportunities so that you can put some silver dollars into your piggy

bank.

Because of currency crosses, you now have the opportunity to match the currency of the best performing economy against that of the

weakest economy without having to deal with the U.S. dollar.

基于基本面制定交易计划

如果澳大利亚方面有强劲的经济数据公布,你很可能会考虑买入澳元。你的第一反应可能汇市买入澳元/美元。

但是,如果在同时,美国方面最近公布的经济数据也表现强劲呢?澳元/美元汇价很可能小幅波动。

你的一种选择是,选择一种相对于澳大利亚经济表现疲软的国家或经济体货币,那么,你应该怎么做呢?

哈,这得感谢上帝创造了交叉货币对!

比如说,你在交易之前进行了一番基本面方面的研究,你从财经日历上注意到,日本的经济表现目前不太好。

你应该怎么做呢?

当然,和大多数精明的交易者一样,你会抓住眼下机会,选择做多澳元/日元。

抓住某一特定的交易机会时作为一名交易者基本的素质,只有这样,你才可以将外汇市场上滚滚的美元装进你的个人账户中。

由于交叉货币对的存在,现在你可以在不交易美元的情况下,选择交易那些经济表现最好的经济体货币兑那些经济表现最差经济体的货币。

How to Trade a Synthetic Currency Pair and Why You Probably Shouldn’t

Sometimes institutional forex traders can’t trade certain currency crosses because they trade in such high volume that there isn’t

enough liquidity to execute their order.

In order to execute their desired trade, they have to create a “synthetic pair“.

How to Create a Synthetic Currency Pair

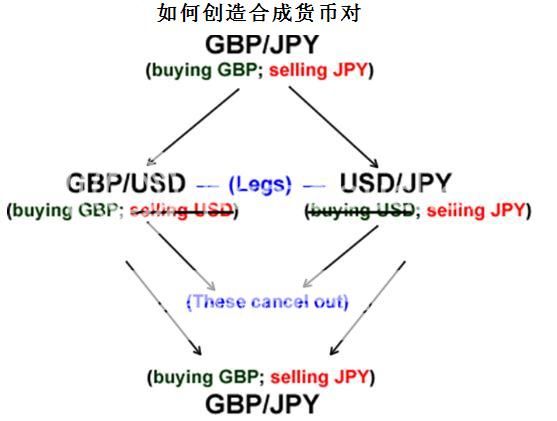

Let’s say that an institutional forex trader wants to buy GBP/JPY but can’t because there isn’t enough liquidity. To execute this

trade, they would have to buy both GBP/USD and USD/JPY (earlier in this lesson, we learned that these pairs are called its legs).

They are able to do this because there is plenty of liquidity in GBP/USD and USD/JPY which means they can make large orders.

If you’re a retail forex trader, and you wanted to pretend to trade like an institutional trader, then you could technically trade

synthetic currency pairs as well. But it wouldn’t be too smart.

Ever since the great Al Gore “invented the internet,” technology has improved to the point now that even weird currency crosses like

GBP/NZD or CHF/JPY can now be traded on your forex broker’s platform. Aside from having access to a larger “menu” of currency pairs to

trade, the spreads would be tighter on the crosses compared to the synthetic pair you’d create.

And let’s not forgot about margin use! Creating a synthetic currency pair requires you to open two separate positions and each position

requires its own margin. This locks up unnecessary capital in your trading account when you can simply trade the cross-currency and save

on margin.

So unless you’re trading yards (forex slang term for one BILLION units), forget synthetic currency pairs and stick to currency crosses.

You will be savings yourself some pips (thanks to a tighter spread) as well as freeing up your capital so you can take on more trades.

创造合成货币对

有些时候,机构交易者并不能够交易特定的交叉货币对,因为市场没有足够的流动性来执行他们的定单。

为了执行他们想要的交易,他们必须创造”合成货币对”。那么,什么是合成货币对呢?

假定你已经做了相关分析,并且得出结论认为英镑比较强,日元比较弱。但是你的平台没有英镑/日元这个货币对,难道你就失去了这次交易机会?不!你可以建立一个合成货币对来做多英镑/日元。一般的交易商都提供有英镑/美元,美元/日元,我们可以通过对这两组货币对的交易,间接建立起对英镑/日元这组货币对的交易,具体方法如下:

在做多英镑/美元的同时,再做多美元/日元,前提条件是交易的手数必须要完全一样。大家都知道,我们做多英镑/美元,其实是买进了英镑,卖出了美元;而我们在做多美元/日元的时候,则是买进了美元,卖出了日元。在第一组货币对的交易中,卖出的美元与第二组货币对中买进的美元相互抵消,所以最终结果其实是建立起了做多英镑/日元的结构了。

交易者能够这么做,是因为英镑/美元和美元/日元相当具有流动性,这也意味着,他们可以任意下定单。

如果你是一名外汇散户,而且你打算和机构交易者一样交易,那么,技术上来说,你也可以进行合成货币对交易。但是,你这样做并非那么精明。

随着互联网技术的发展,更为奇异的交叉货币对,诸如英镑/纽元、瑞郎/日元现在都可以在你的经纪商交易平台上进行交易。除去我们通常交易的大多数货币对不说,交易交叉货币对的点差较我们创造性的进行合成货币对交易的点差要低很多。

同时,我们也不要忘了保证金的使用。进行合成交易需要你开设两个独立的仓位,而且每一个仓位都要你投入保证金。

相比于合成交易,当你进行简单的交叉货币对交易时,你可以避免使用不必要的资金,进而节省你的保证金。

所以,除非你的交易单位以码(100万单位的俗称)计,那么,还是放弃合成交易,转而选择交易交叉货币对吧。这样,你所支出的点差要更低,且可以节省更多的资本进行更多的交易。

Trading the Euro and Yen Crosses

After the U.S. dollar, the euro and yen are the most traded currencies. And like the U.S. dollar, the euro and yen are also held as

reserve currencies by different countries. So this makes the euro and yen crosses the most liquid outside of the U.S. dollar-based

“majors.”

Trading the Euro Crosses

The most popular EUR crosses are EUR/JPY, EUR/GBP, and EUR/CHF.

News that affects the euro or Swiss franc will be felt more in EUR crosses than EUR/USD or USD/CHF.

U.K. news will greatly affect EUR/GBP.

Oddly enough, U.S. news plays a part in the movement of the EUR crosses. U.S. news makes strong moves in GBP/USD and

USD/CHF. This not only affects the price of the GBP and CHF against the USD, but it could also affect the GBP and CHF against the EUR.

A big move higher in the USD will tend to see a higher EUR/CHF and EUR/GBP and the same goes for the opposite direction.

Confused? Ok ok…let’s break this down.

Let’s say that the U.S. shows positive economic data causing the USD to rise. This means that GBP/USD would fall, driving the price of

the GBP down. At the same time USD/CHF would rise, also driving the price of the CHF down.

The drop in GBP price would then cause EUR/GBP to rise (since traders are selling off their GBP).

The drop in CHF price would also cause EUR/CHF to rise (since traders are selling off their CHF).

Conversely, this would also work in the opposite direction if the U.S. showed negative economic data.

Trading the Yen Crosses

The JPY is one of the more popular cross currencies and it is basically traded against all of the other major currencies.

EUR/JPY has the highest volume of the JPY crosses according to the latest Triennial Central Bank Survey from the Bank for International Settlements.

GBP/JPY, AUD/JPY, and NZD/JPY are attractive carry trade currencies because they

offer the highest interest rate differentials against the JPY.

When trading JPY currency cross pairs, you should always keep an eye out on the USD/JPY. When key levels are broken or resisted on this

pair, it tends to spill over into the JPY cross pairs.

For example, if USD/JPY breaks out above a key resistance area, it means that traders are selling off their JPY. This could prompt the

selling of the JPY against other currencies. Therefore you could expect to see EUR/JPY, GBP/JPY, and other JPY crosses to rise as

well.

The CAD/JPY

Over recent years, this currency cross has become very popular, becoming highly correlated with the price of oil.

Canada is second

largest owner of oil reserves and has benefited with the rise of oil prices.

On the other hand, Japan is heavily reliant on the importing of oil. In fact, over 99% of Japan’s crude oil is imported as it

has almost no native oil reserves.

These two factors have caused an 87% positive correlation between the price of oil and CAD/JPY.

欧元和日元交叉盘

除了美元之外,欧元和日元是交易最为频繁的货币。同时,和美元一样,一些国家也持有欧元和日元作为其外汇储备。所以,日元和日元交叉货币对成为美元直盘之外,流动性最高的货币对。

交易欧元货币对

最常见的欧元交叉货币对是欧元/日元、欧元/英镑以及欧元/瑞郎。

消息面对欧元或瑞郎交叉盘的影响较欧元/美元或美元/瑞郎的影响要大得多。

英国方面消息也会对欧元/英镑造成很大的影响。

奇怪的是,美国方面消息也会对欧元交叉盘走势造成较大影响。美国方面消息会对英镑/美元以及美元/瑞郎造成强劲影响。这不仅会影响到英镑和瑞郎兑美元的汇价,也有可能影响到英镑和瑞郎兑欧元的汇率。

美元的走强可能促使欧元/瑞郎以及欧元/英镑的走强,而美元的走软,也可能促使欧元/瑞郎以及欧元/英镑的走软。

迷惑了?好吧,让我们分开细说。

比如说,美国方面公布的正面经济数据导致美元走强。这意味着英镑/美元将下跌,进而打压英镑走低。与此同时,美元/瑞郎将走高,这也会打压瑞郎下跌。

英镑汇价的下跌将导致欧元/英镑的上涨,因为交易者都在卖出英镑。

瑞郎的下跌也会导致欧元/瑞郎的上涨,因为交易者都在卖出瑞郎。

与之相反的是,如果美国方面公布的经济数据表现负面,则可能导致相应货币对走势呈相反方向波动。

交易日元交叉盘

日元也是最受交易者欢迎的币种之一,日元基本上可以和所有的主要货币进行交易。

截至2010年2月,欧元/日元在日元交叉盘中的交易量达到最高水平。

英镑/日元、澳元/日元、纽元/日元也是吸引人的套息交易货币,因为上述货币与日元的利差最大。

当进行日元交叉盘交易时,你应该始终对美元/日元保持关注。当美元/日元突破关键价位时,日元交叉盘也会受到明显影响。

比如说,如果美元/日元突破某一关键阻力位,则意味着交易者正在卖出日元。这可能促使他们也同时卖出日元兑其他货币。因此,你应该预计欧元/日元、英镑/日元以及其他日元交叉货币对也走低。

加元/日元

在最近几年,加元/日元已经变为非常流行的交叉货币对,该货币对与油价的关联性也非常之高。

加拿大所有用的石油储备居全球之二,该国也因油价的上涨获益颇多。

另一方面,日本则严重依赖石油进口。事实上,日本99%的原油都是进口的,因为该国几乎不存在天然的石油储备。

上述两方面因素导致油价和加元/日元之间的正关联性达到87%。

How to Use Currency Crosses to Trade the Majors

Even if you don’t ever want to trade the currency crosses and simply stick to trading the majors, you can use crosses to help you make

better forex trading decisions.

Here’s an example…

Currency crosses can provide clues about the relative strength of each major currency pair.

Let’s say you see a buy signal for EUR/USD and GBP/USD but you can only take one trade.

Which one do you take?

Simply looking at your crystal ball and guessing isn’t likely to result in the right answer.

To find the right answer, you would look at EUR/GBP cross.

If EUR/GBP is trending downward, this indicates that the pound is relatively stronger than the euro at the moment.

So the right answer would be to buy GBP/USD instead of EUR/USD due to the pound’s relative strength against the euro.

Since the euro is weaker, relative to the pound, if it proves to strengthen against the U.S. dollar, it is likely to strengthen LESS

than the pound.

If the U.S. dollar weakens across the board, GBP/USD you would make more pips since it would rally higher than EUR/USD.

So GBP/USD is the better trade.

Know Which Currency Cross to Use

Let’s say you’re bearish on the U.S. dollar. How will you trade?

- Can’t decide whether to buy EUR/USD or sell USD/CHF? Look at EUR/CHF.

- Can’t decide whether to buy USD/CHF or USD/JPY? Look at CHF/JPY.

- Can’t decide whether to buy EUR/USD or sell USD/JPY? Look at EUR/JPY.

- Can’t decide whether to buy GBP/USD or sell USD/CHF? Look at GBP/CHF.

- Can’t decide whether to buy GBP/USD or sell USD/JPY? Look at GBP/JPY.

So always remember, looking at currency cross pairs could give you an idea of the relative strength of a particular currency.

观察交叉盘进行直盘交易

即使你并不打算交易交叉货币对,只是想交易主要的美元直盘,你也可以利用交叉货币对帮助你做出更好的交易决策。

下面就是一个例子。

交叉货币对能够提供每种主要货币对之间的相对强弱关系线索。

比如说,你看到欧元/美元以及英镑/美元都发出了买入信号,但问题是你只能进行一种货币对的交易。

你应该选择哪种呢?

如果你只是看着你的水晶球,并开始猜测结果,你可能不会因此而得得到好的答案。

为了获得正确的答案,你可以观察欧元/英镑交叉盘。如果欧元/英镑正在走低,这意味着,英镑相对于欧元在此时更加的强劲。

所以,正确的答案应该是买入英镑/美元,而非欧元/美元,因为英镑较欧元要更强。

由于欧元较英镑表现要弱,如果欧元表现要强于美元,那么,欧元/美元的强势要逊于英镑/美元。

如果美元全盘走软,选择做多英镑/美元,你可能会获得更多的回报,因为英镑/美元的涨势将好于欧元/美元。

所有说,英镑/美元是更好的交易选择。

你也可以针对任一主要货币对进行相对走势强弱分析。。。

● 难以决定到底是买入欧元/美元或卖出美元/瑞郎?还是看看欧元/瑞郎吧。

● 难以决定是买入美元/瑞郎还是美元/日元?看看瑞郎/日元吧。

● 难以决定是买入欧元/美元还是美元/日元?看看欧元/日元报。

● 难以决定是买入英镑/美元还是卖出美元/瑞郎?看看英镑/瑞郎吧。

● 难以决定是买入英镑/美元还是卖出美元/日元?看看英镑/日元吧。

所以,请始终记住,观察交叉货币对的走势,能够该你提供特定货币对的相对强弱线索。

How Cross Currency Pairs Affect Dollar Pairs

Let’s pretend the Fed announces they will raise interest rates. The market quickly starts buying the U.S. dollar across all major

currencies….EUR/USD and GBP/USD fall while USD/CHF and USD/JPY rise.

You were short EUR/USD and were pleased to see price move in your favor making you some pips, but right before you were about to break

out the cigar, you notice your friend who was long USD/JPY made a lot more pips than you.

You’re like “What’s up with that yo?”

You compare the charts of EUR/USD and USD/JPY and see that USD/JPY made the bigger move. It broke through a major technical resistance

level and shot up 200 pips while EUR/USD barely shot down 100 pips and failed to break a major support level.

You’re thinking to yourself, “If the U.S. dollar was being bought across the board, then how come my EUR/USD trade looks so weak

compared to my friend’s USD/JPY trade?”

This is due to the currency crosses! In this particular example, EUR/JPY.

When USD/JPY broke through its major resistance level, the combination of stop losses being hit and breakout traders jumping on the

bandwagon pushed it even higher.

Since buying more USD/JPY weakens the yen, this would cause EUR/JPY (and possibly other yen-based pairs) to break through its major

resistance level, once again hitting stops and attracting breakout traders, pushing EUR/JPY even higher.

This causes the euro to strengthen and slows down the descent of your EUR/USD trade. The EUR/JPY cross buying acts a “parachute” and

this is why EUR/USD didn’t move as much or as fast as the USD/JPY.

So even if you only trade the major currencies, cross currency pairs still have an effect on your trades!

交叉盘如何影响到美元货币对

我们假设美联储宣布其将会采取加息措施。市场上的美元兑主要货币的买盘迅速涌现。欧元/美元、英镑/美元下跌,而美元/瑞郎以及美元/日元上涨。

你选择做空欧元/美元,并很高兴的看到,汇价的走势令你不断获利,但是,当你准备满意的点起一根雪茄时,你忽然发现,你选择做多美元/日元的朋友获得的点数收益要超过你不少。

你会问,这到底是怎么回事?

你对欧元/美元以及美元/日元走势图进行了对比,发现美元/日元变动幅度要更大。美元/日元突破某一重大技术阻力位,涨势超过200点,而欧元/美元仅仅只下跌了100点,且并未跌破某一关键支撑。

你会自己问自己,如果美元全盘受到每盘支持,那么,为什么欧元/美元走势相对于美元/日元走势要弱呢?

这和交叉货币对有关。在本例中,有关欧元/日元。

当美元/日元突破其主要阻力位时,在汇价触发止损买盘的双从推动下,美元/日元进一步走高。

由于更多的美元/日元买盘会导致日元走软,这可能促使欧元/日元(或其他日元交叉盘)也突破其主要阻力位,一旦触发止损买盘,并吸引寻求突破行情的交易者入场,欧元/日元将会进一步走高。

这会导致欧元走强,并减缓欧元/美元的下跌势头。在这里,欧元/日元买盘取到了关键性作用,这也是为什么,欧元/美元跌势并没有出现像美元/日元那么大的原因。

所以说,即使你只是交易涉及到美元的主要货币对,交叉盘仍然会对你的交易造成影响。

Summary Of Currency Crosses

As you can see, there are many, many trade opportunities presenting themselves in the forex market other than figuring out what

the Greenback will do any given day – and now you know how to find them! Here are a couple of things to remember:

- Crosses give forex traders more pairs to trade, which means more trading opportunities.

- We normally see cleaner trends and ranges on currency crosses than we do on majors.

- You can take advantage of interest rate differentials by trading currency crosses.

- Do your due diligence and analysis and match the strong currencies against the weak ones.

- If the pair you are looking to trade isn’t available with your broker, don’t worry. You know how to create a synthetic pair by

simultaneously going long or short two major pairs to create one currency cross. - The most popular euro crosses are the EUR/JPY, EUR/GBP, and EUR/CHF.

- GBP/JPY, AUD/JPY, and NZD/JPY are attractive carry trade currencies because they offer the highest interest rate differentials

against the JPY. - When trading obscure currency crosses, watch out for wild price swings and wider spreads.

- Even if you wanna stick to the majors, you can make use of currency crosses to help you decide between which pairs to trade as

crosses can signal which currency is stronger. - Don’t forget that moves in currency cross pairs can have an effect on the majors.

- Last tip; please be conscientious of the pip value of the cross you are trading. Some crosses will have a higher or lower pip value

than the majors. This information is good to know for your risk analysis. - So, on the days you may not see any opportunities in the major pairs, or if you want to avoid the volatility of a US news event,

check out some the currency crosses. You may never know what you may find!

总结:交叉货币对

PS:交叉货币对为你提供更多交易机会

正如你所看到的,除了涉及到美元的主要货币对外,交叉货币对为你提供了更多的交易机会。

● 交叉货币对丰富了交易者的交易选择,这意味着他们的交易机会大为增加。

● 我们通常看到,交叉货币对的趋势走势较直盘更为明显。

● 你可以利用利差优势来交易交叉货币对。

● 如果你的经纪商平台并不提供你想要交易的货币对,不要着急,

你已经知道了如何创造合成货币对,并通过这种方法来间接交易某一交叉货币对。

● 最常见的交叉货币对是欧元/日元、欧元/英镑以及欧元/瑞郎。

● 英镑/日元、澳元/日元以及纽元/日元是吸引人的套息交易货币对,

因为英国、澳大利亚和新西兰所提供的利率都要高于日本。

● 当交易非常见交叉货币对时,需要警惕这些货币对的剧烈波动,以及交易所需付出的较高点差。

● 即使你只想交易直盘,你也可以利用交叉货币对来帮助你做出直盘交易策略,

因为交叉货币对可以显示不同货币之间的相对强弱关系。

● 不要忘了,交叉货币对的走势也会影响到美元直盘的走势。

● 最后的建议,请记住,一些交叉货币对的点值要高于或低于主要货币对。

这一信息有利于你更好的进行风险分析。

● 所以,如果哪一天你在直盘上难以寻找到好的交易机会,

或者是你想要避开美国方面消息对市场所造成的较大波动,你可以选择交易交叉货币对。

You can find the best online HTML, CSS and JavaScript tools in one place.

Online editors, code optimizers and more.