Elliott Wave Theory

Back in the old school days of the 1920-30s, there was this mad genius and professional accountant named Ralph Nelson Elliott.

By analyzing closely 75 years worth of stock data, Elliott discovered that stock markets, thought to behave in a somewhat chaotic manner, actually didn’t.

When he hit 66 years old, he finally gathered enough evidence (and confidence) to share his discovery with the world.

He published his theory in the book entitled The Wave Principle.

According to him, the market traded in repetitive cycles, which he pointed out were the emotions of investors caused by outside influences (ahem, CNBC, Bloomberg, ESPN) or the predominant psychology of the masses at the time.

Elliott explained that the upward and downward swings in price caused by the collective psychology always showed up in the same repetitive patterns.

He called these upward and downward swings “waves”.

He believes that, if you can correctly identify the repeating patterns in prices, you can predict where price will go (or not go) next.

This is what makes Elliott waves so appealing to traders. It gives them a way to identify precise points where price is most likely to reverse. In other words, Elliott came up with a system that enables traders to catch tops and bottoms.

So, amidst all the chaos in prices, Elliott found order. Awesome, huh?

Of course, like all mad geniuses, he needed to claim this observation and so he came up with a super original name: The Elliott Wave Theory.

But before we delve into the Elliott waves, you need to first understand what fractals are.

Fractals

Basically, fractals are structures that can be split into parts, each of which is a very similar copy of the whole. Mathematicians like to call this property “self-similarity”.

You don’t need to go far to find examples of fractals. They can found all over nature!

A sea shell is a fractal. A snow flake is a fractal. A cloud is a fractal. Heck, a lightning bolt is a fractal.

So why are fractals important?

One important quality of Elliott waves is that they are fractals. Much like sea shells and snow flakes, Elliott waves could be further subdivided into smaller Elliot waves.

Ready to be an Elliottician now? Read on!

艾略特波浪理论

通过分析了将近75年的股票相关数据,艾略特发现:虽然大多数人认为股市的运动是无规则方式的运行,但其实并非如此。

当他到了66岁时,终于收集到足够的证据(和信心),并与全世界分享他的发现。

他把他的理论写在他的著作《波浪理论》里。

据他的说法,交易市场的价格远动在一种重复的循环形态中,他还指出投资者们的情绪受到外界的影响(就像CNBC新闻台、Bloomberg资讯台、ESPN联播网)或是当时广大民众的主要情绪所影响。

艾略特解释说,价格的波动上升和下跌,因为受到群体心理的影响,所以总是呈现出同样的形态。

他把这些上升和下降的波动称为“浪”。

他坚信,如果你能正确地,辨认出价格正重复的形态,你就可以预测价格,下一步会(或不会)往哪方向走。

这就是为什么艾略特波浪会对交易者这么的有吸引力。因为它为交易者们提供了一个方法,来辨认价格会在什么位置,最有可能反转。换句话说,艾略特想出了一个系统,让交易者们可以抓住顶部和底部。

因此,在价格所有的混沌运动中,艾略特发现了规律。很神奇吧,是吗?

当然,像所有的疯狂天才一样,他需要为这观察方式定义,所以他想出了一个超级独创的名称:艾略特波浪理论。

但在我们深入了解艾略特波浪之前,你需要先了解一下什么是 分形 。

分形

基本上,分形的结构,可以分割成几部分,它们每一个副本都是非常的相似。 数学家喜欢把这种特性称为“自相似性”。

你并不需要去到远方寻找分形的例子。它们全都可以从大自然里发现!

一个贝壳是一个分形、一片雪花是一个分形、一片云是一个分形, 哎呀,连一个闪电也是一个分形。

那么,为什么分形如此重要呢?

艾略特波浪的一个重要特性就是它们也是分形。 就像贝壳和雪花,艾略特波浪可以进一步细分成更小的艾略特波浪。

准备好了吗? 继续阅读吧!

Impulse Waves

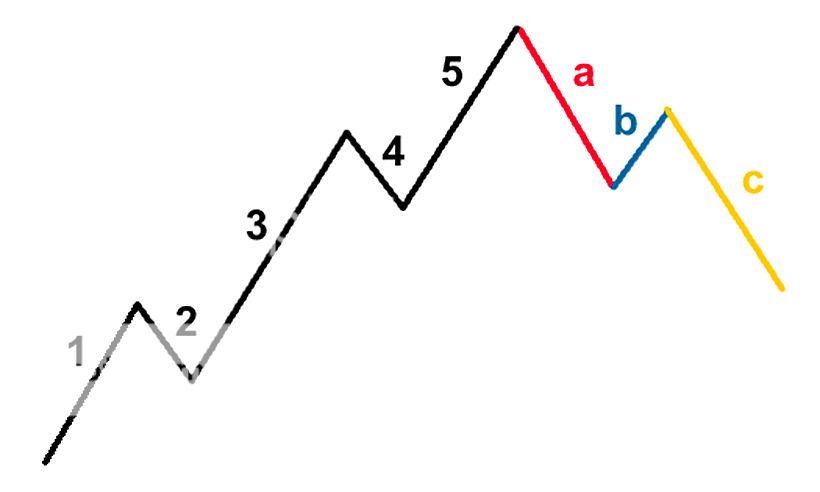

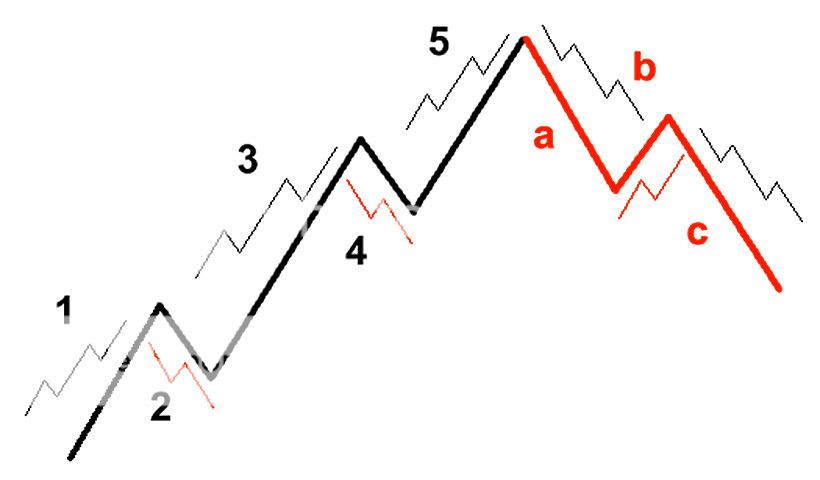

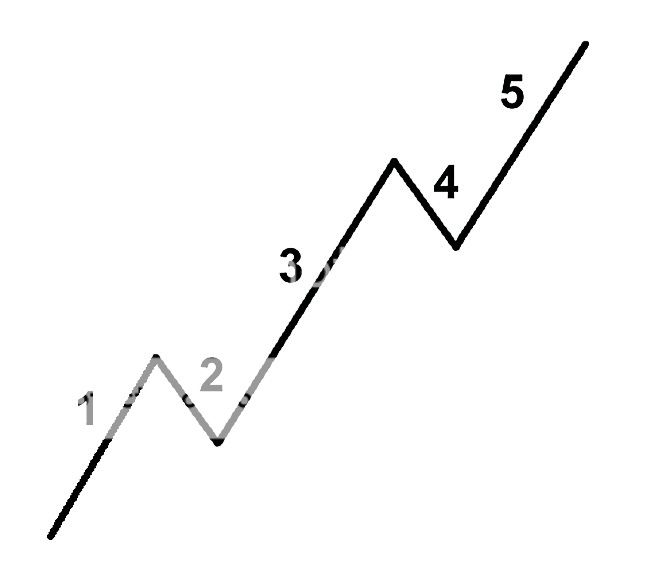

Mr. Elliott showed that a trending market moves in what he calls a 5-3 wave pattern.

The first 5-wave pattern is called impulse waves.

The last 3-wave pattern is called corrective waves.

In this pattern, Waves 1, 3, 5 are motive, meaning they go along with the overall trend, while Waves 2 and 4 are corrective.

Do not confuse Waves 2 and 4 with the ABC corrective pattern (discussed in the next section) though!

Let’s first take a look at the 5-wave impulse pattern. It’s easier if you see it as a picture:

Here is a short description of what happens during each wave.

We’re going to use stocks for our example since stocks are what Mr. Elliott used but it really doesn’t matter what it is. It can easily be currencies, bonds, gold, oil, or Tickle Me Elmo dolls. The important thing is the Elliott Wave Theory can also be applied to the foreign exchange market.

Wave 1

The stock makes its initial move upwards. This is usually caused by a relatively small number of people that all of the sudden (for a variety of reasons, real or imagined) feel that the price of the stock is cheap so it’s a perfect time to buy. This causes the price to rise.

Wave 2

At this point, enough people who were in the original wave consider the stock overvalued and take profits. This causes the stock to go down. However, the stock will not make it to its previous lows before the stock is considered a bargain again.

Wave 3

This is usually the longest and strongest wave. The stock has caught the attention of the mass public. More people find out about the stock and want to buy it. This causes the stock’s price to go higher and higher. This wave usually exceeds the high created at the end of wave 1.

Wave 4

Traders take profits because the stock is considered expensive again. This wave tends to be weak because there are usually more people that are still bullish on the stock and are waiting to “buy on the dips.”

Wave 5

This is the point that most people get on the stock and is most driven by hysteria. You usually start seeing the CEO of the company on the front page of major magazines as the Person of the Year. Traders and investors start coming up with ridiculous reasons to buy the stock and try to choke you when you disagree with them. This is when the stock becomes the most overpriced. Contrarians start shorting the stock which starts the ABC pattern.

Extended Impulse Waves

One thing that you also need to know about the Elliott Wave Theory is that one of the three impulse waves (1, 3, or 5) will always be “extended”. Simply put, there will always be one wave that is longer than the other two, regardless of degree.

According to Elliott, it is usually the fifth wave which is extended. As time went by, this old school style of wave labeling has changed because more and more people started labeling the third wave as the extended one.

Check out this forum thread for more Elliott Wave diagrams.

5 – 3 波浪形态

Elliott先生表明,一个趋势市场的波动,是属于他所谓的5-3浪形态。

前面的5浪形态称为 推动浪 。

后面的3浪形态称为 调整浪 。

在这个形态中,浪1、3、5是 驱动浪,这意味着它们总随着主趋势,而浪2和4是 回调浪 。

不要混淆浪2、4和浪ABC调整形态(下一节将谈论)!

让我们先看看推动浪的5浪形态。如果你看到它的图画,很容易就会了解的:

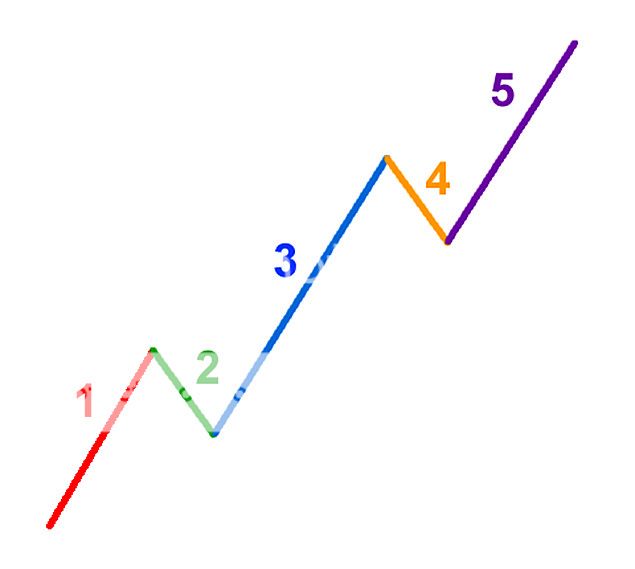

这看起来还是有点混淆,让我们给这坏家伙漆上点颜色看看。

帅气吧!它是如此的漂亮!我们喜欢五颜六色,所以我们在数浪时,顺便为每个浪涂上不同的颜色。

这里会分别对每一浪做简短的说明。

我们将使用股票市场做为例子,因为艾略特先生原本是以股票为基础,但这其实没有什么问题。其实它更适合应用于分析货币、债券、黄金、石油或芝麻街Elmo 搔痒娃娃的市场价格。 最重要的是,艾略特波浪理论同样能被应用到外汇市场中。

第一浪

股票最初的上涨趋势,这通常是因为一群人,突然间(由于各种真实或幻想的原因) 认为股票的价格相当便宜了,所以择机买进。这导致了价格的上涨。

第二浪

部分在之前买进的人士认为股票已经超值,并且获利了结,这导致股价回落。然而,由于捡便宜的买家多过买家,所以股价并没有跌回到之前第一浪的低点。

第三浪

它通常是最长和最强劲的一浪,该公司的股价已经吸引了广大股民的注意力。越来越多的人知道了该股,并积极买进,这将导致股票的价格越涨越高。第三浪通常远远超出了第一浪的最高点。

第四浪

大部分的交易者们综合分析股市已经偏高,开始平仓获利。这段波浪往往回调比较疲弱,而且显得比较复杂,因为同时有更多的股民,觉得股票仍在牛市,正等待着“逢低买进。”

第五浪

这一浪中所有的买家都进场了,股价的波动大部分是被歇斯底里所驱动着。你通常开始在各大名人杂志的首页,看到该公司的CEO。并且开始有交易者们和投资者们用各种荒谬乐观的理由来买进该公司的股票,当你反对他们时,他们恨不得把你给掐死。这时候股价往往是严重超值的,反向交易者尝试在股票出现ABC形态的时候,开始布置空单。

延伸的驱动浪

关于艾略特的波浪理论,还有一件事您也需要了解,就是三波的驱动浪(浪1、3和5)中将永远有一浪是“延伸浪”。简单地说,总是会有一浪,波长比其他两浪更长,不论它的波幅有多大。

据艾略特所说,通常延伸浪是出现在第五浪。随着时间的流逝,这延伸浪的旧理论已经改变了,因为越来越多的人开始把第三浪定义为延伸浪了。

Corrective Waves

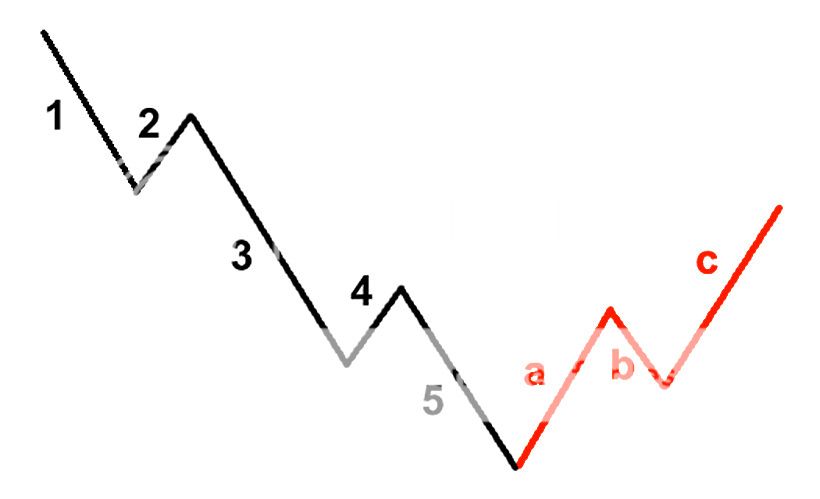

The 5-wave trends are then corrected and reversed by 3-wave countertrends. Letters are used instead of numbers to track the correction. Check out this example of a smokin’ hot corrective 3-wave pattern!

Types of Corrective Wave Patterns

According to Elliott, there are 21 corrective ABC patterns ranging from simple to complex.

“Uh 21? I can’t memorize all of that! The basics of the Elliott Wave Theory are already mind-blowing!”

Take it easy, young padawan. The great thing about Elliott Wave is you don’t have to be above the legal drinking age to trade it! You don’t have to get a fake ID or memorize all 21 types of corrective ABC patterns because they are just made up of three very simple easy-to-understand formations.

Let’s take a look at these three formations. The examples below apply to uptrends, but you can just invert them if you’re dealing with a downtrend.

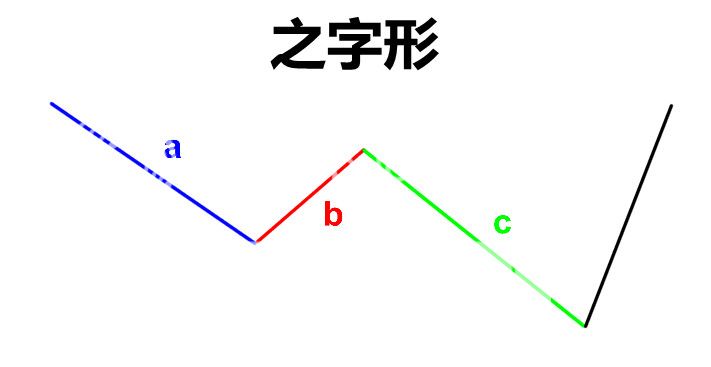

The Zig-Zag Formation

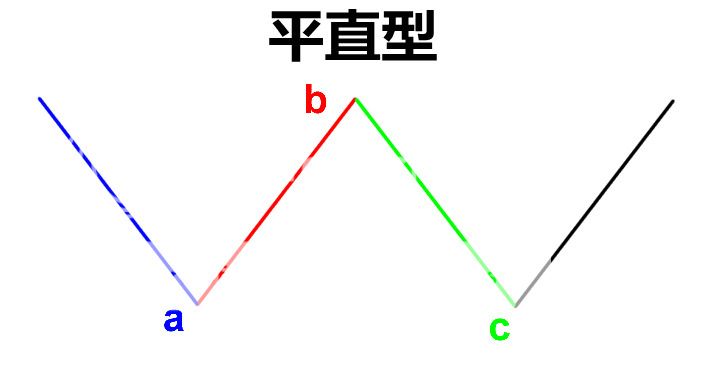

The Flat Formation

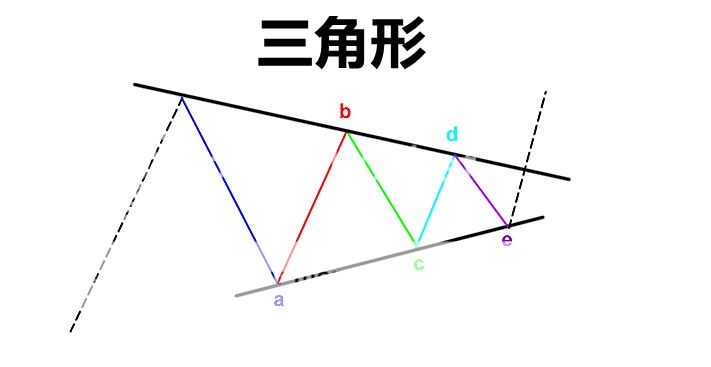

The Triangle Formation

Drop by our forums if you want to see the bullish and bearish versions of these Elliott Wave patterns.

ABC调整浪形态

当5浪形态完成后,随后就是调整,或反转的3浪回调。这3浪是用字母而非数字,来标示调整浪。查看这个例子,一个火辣辣的调整3浪形态!

在第一个例子中,虽然我们使用了一个牛市来示范,但这不意味着艾略特波浪理论,就不能运用在熊市中。同样的5-3波浪形态也可以是这样的:

调整浪形态的类型

按照艾略特所说,ABC调整浪共有21种形态,从简单到复杂。

“呃21种?我肯定不能记住它们全部!艾略特波浪理论的基础课程,已经成为梦幻泡影了!”

别紧张,年轻的学徒。艾略特波浪理论最棒的地方,就是你并不需要超过法定的饮酒年龄就可以使用它!你也不再需要千辛万苦的去伪造假身份证或记忆完21种调整浪形态,因为它们已经改良成三个非常简单且易于理解的形态。

让我们来看看这三个形态。这些都是用于上涨趋势的例子,但你也可以在下跌趋势中使用,你只需要反转它们就可以了。

“之字形”调整浪形态

之字形形态是在波动非常激烈的时候形成的,而且价格现在的走势是和之前的推动浪是相反的。通常和A浪、C浪的长度相比,B浪是最短的话。这些之字形形态可能会出现2个、甚至3个在一个调整浪中(2至3个的之字形形态连在一起的情况)。就像其他所有的波浪一样,每个之字形形态的波浪,可以再被细分为5浪形态。

“平直型”调整浪形态

平直型形态是最简单的横向回调浪。在平直型形态中,ABC浪的长度通常是相等的,但是B浪可以强过A浪,而C浪不能强过B浪。我们通常会说,B浪有时候会超过A浪的起点。

“三角形”调整浪形态

三角形的形成是由于调整浪的形态,受到趋势线的会聚或发散的限制。三角形形态是由5浪构成的,它会破坏一个横向的走势。这些三角形形态可以是:对称的、下降的、上升的,或扩散的。

Elliott Waves Within an Elliott Wave

Like we mentioned earlier, Elliott waves are fractals. Each wave is made of sub-waves. Huh? Let me show you another picture. Pictures are great, aren’t they? Yee-haw!

Always remember that each wave is comprised of smaller wave patterns. This pattern repeats itself…

FOREVER!

To make it easy to label these waves, the Elliott Wave Theory has assigned a series of categories to the waves in order of the largest to the smallest. They are:

- Grand Supercycle (multi-century)

- Supercycle (about 40–70 years)

- Cycle (one year to several years)

- Primary (a few months to a couple of years)

- Intermediate (weeks to months)

- Minor (weeks)

- Minute (days)

- Minuette (hours)

- Sub-Minuette (minutes)

A Grand Supercycle is made up of Supercycle waves which is made up of Cycle waves which is made up Primary waves, which is made up of Intermediate waves which is made up of Minor waves which is made up of Minute waves which is made up of Minuette waves which is made up of Sub-Minuette waves. Did you get all that?

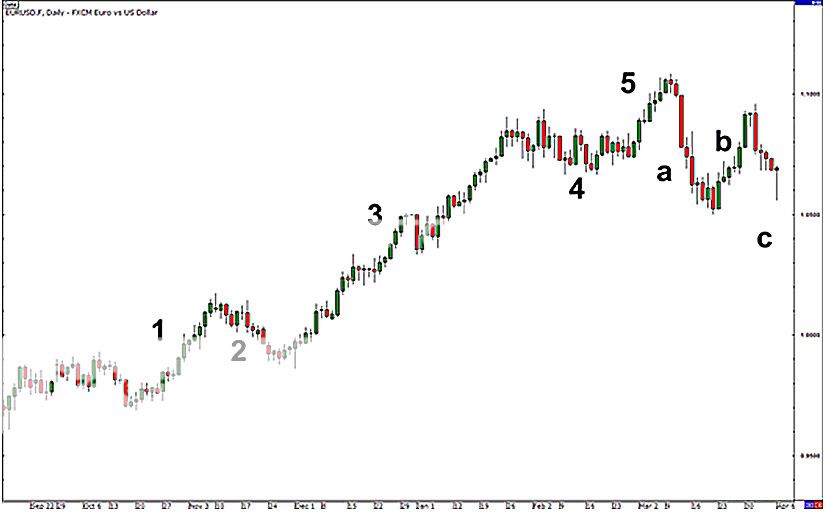

Okay, to make things much clearer, let’s see how an Elliott Wave looks in real life.

As you can see, waves aren’t shaped perfectly in real life. You’ll also learn it’s sometimes difficult to label waves. But the more you stare at charts the better you’ll get.

Besides, we’re not going to let you go at it alone! In the following sections, we’ll give you some tips on how to correctly and easily identify waves as well as teach you how to trade using Elliott Waves. Surf’s up!

众浪中还有小浪

就像我们前面提到的,艾略特波浪也属于分形,每一浪都是由数个小波浪所组成的。 咦?让我给你看另一张图片。图片是伟大的,不是吗?哇哈哈!

你注意到吗?波浪1、3和5的形态,是由一个更小的5波推动浪构成的,而波浪2和4是由更小的3波调整浪所构成。

永远记住,每一个浪都是由更小的波浪形态所组成的。这形态的情况会一直重复…

直到永远!

为了更简单的标识这些波浪的大小形态,艾略特波浪理论把它们从最大到最小的波浪,分配到一系列的等级类别中。 它们是:

• 超大级循环浪(Grand Superrcyclc)

• 超级循环浪(Supercycle)

• 循环浪(Cycle)

• 基本浪(Primary)

• 中型浪(Intermediate)

• 小型浪(Minor)

• 细浪(Minute)

• 微浪(Minuette)

• 次微浪(Subminuette)

一个超大级循环浪是由超级循环浪组成、超级循环浪组成又由循环浪组成,而循环浪是由基本浪组成,基本浪又是由中型浪组成,这样一直到最小等级的次微浪,即大的是由小的组成的。你明白了吗?

好吧,为了让说明变得更清晰,让我们看看艾略特波浪在实际例子中,是什么摸样的。

正如你看到的,波浪形态在实际例子中并不完美。 您也应该发现到,有时很难标志是第几级的波浪。 但你盯着图表看的时间越长,你就会辨识出更多级别的浪。

此外,我们也不会让你一个人自己在那数浪!在下面的课程中,我们会给你一些提示,关于如何正确地、轻松地,识别出波浪,同时教你如何使用艾略特波浪进行交易。冲浪开始咯!

3 Cardinal Rules of the Elliott Wave Theory

As you may have guessed, the key in using the Elliott Wave Theory in trading is all about being able to correctly identify waves.

By developing the right eye in recognizing what wave the market is in, you will be able to find out which side of the market to trade on, long or short.

There are three cardinal “cannot-be-broken” rules in labeling waves. So, before you jump right in to applying the Elliott Wave Theory to your trading, you must take note of the rules below.

Failing to label waves correctly can prove disastrous to your account.

3 Cardinal Rules of the Elliott Wave Theory

- Rule Number 1: Wave 3 can NEVER be the shortest impulse wave

- Rule Number 2: Wave 2 can NEVER go beyond the start of Wave 1

- Rule Number 3: Wave 4 can NEVER cross in the same price area as Wave 1

Then, there are the guidelines that help you in correctly labeling waves. Unlike the three cardinal rules, these guidelines can be broken. Here they are:

- Conversely, sometimes, Wave 5 does not move beyond the end of wave 3. This is called truncation.

- Wave 5, more often than not, goes beyond or “breaks through” the trend line drawn off Wave 3 parallel to a trend line connecting the start of Waves 3 and 5.

- Wave 3 tends to be very long, sharp, and extended.

- Waves 2 and 4 frequently bounce off Fibonacci retracement levels.

3条基本原则和一些指引

或许您可能已经猜到了,在交易中使用艾略特波浪理论的关键,就是能够正确的数浪。

通过仔细的观察,市场趋势正处于那段的波浪之中,你将能够更好的判断出,该做空还是做多。

在标示波浪时,有三个不能被打破的原则。所以,在你使用艾略特波浪理论运用到交易之前,你必须注意下面的这些规定。

不正确的数浪,对于您的帐户来说可能是灾难性的。

艾略特波浪理论的 3条基本原则

● 原则一:第三浪决不可能是最短的驱动浪

● 原则二:第二浪决不可能低于第一浪起点

● 原则三:第四浪决不可能会重叠到第一浪

然后,还有些指引可以帮助你正确的数浪。

不同于上面的三条基本原则,这些指引是可能被打破的。它们是:

● 有些例外时候,第五浪没有突破第三浪的顶部。

这称为衰竭的“失败浪”

● 第五浪,经常会超出或“突破”第三浪顶部的趋势线,

一条平行与连接第三浪与第五浪起点的趋势线。

● 第三浪的波动往往是非常大、激烈和延伸的。

● 第二浪和第四浪经常在斐波纳契回撤位置反弹。

How to Trade Forex Using Elliott Waves

This is probably what you all have been waiting for – drumroll please – using the Elliott Wave Theory in forex trading! In this section, we will look at some setups and apply our knowledge of Elliott Wave to determine entry, stop loss, and exit points. Let’s get it on!

Hypothetical, will-most-probably-be-right scenario:

Let’s say you wanted to begin your wave count. You see that price seems to have bottomed out and has began a new move upwards. Using your knowledge of Elliott Wave, you label this move up as Wave 1 and the retracement as Wave 2.

In order to find a good entry point, you head back to the School of Pipsology to find out which of the three cardinal rules and guidelines you could apply. Here’s what you found out:

- Rule Number 2: Wave 2 can NEVER go beyond the start of Wave 1

- Waves 2 and 4 frequently bounce off Fibonacci retracement levels

So, using your superior Elliott Waving trading skillz, you decide to pop the Fibonacci tool to see if price is at a Fib level. Holy mama! Price is just chillin’ like ice cream fillin’ around the 50% level. Hmm, this could be the start of Wave 3, which is a very strong buy signal.

Since you’re a smart forex trader, you also take your stop into consideration.

Cardinal rule number 2 states that Wave 2 can never go beyond the start of Wave 1 so you set your stop below the former lows.

If price retraces more than 100% of Wave 1, then your wave count is wrong.

Let’s see what happens next…

Your Elliott Wave analysis paid off and you caught a huge upward move! You go to Vegas (or Macau), blow all your forex profits on roulette, and end right back where you started. Lucky for you we have another hypothetical scenario where you can earn imaginary money again…

Scenario 2:

This time, let’s use your knowledge on corrective waves patterns to grab those pips.

You begin counting the waves on a downtrend and you notice that the ABC corrective waves are moving sideways. Hmm, is this a flat formation in the works? This means that price may just begin a new impulse wave once Wave C ends.

Trusting your Elliott Wave skills, you go ahead and sell at market in hopes of catching a new impulse wave.

You place your stop just a couple of pips above the start of Wave 4 just in case your wave count is wrong.

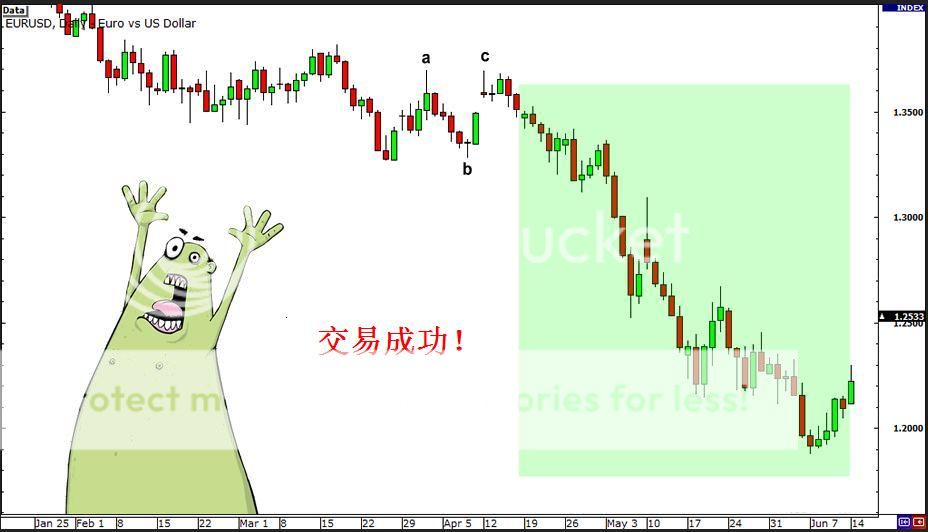

Because we like happy endings, your trade idea works out and nets you a couple thousand pips on this day, which is not always the case.

You have also learned your lesson this time around so you skip Vegas and decide to use your profits to grow your forex trading capital instead.

Learn from your fellow forex traders and discuss Elliott Waves.

如何利用艾略特波浪理论进行交易

这很可能是你一直在等的时刻——利用艾略特波浪理论进行交易。

在本课中,我们将借用我们已经掌握的艾略特波浪理论相关知识确定入场点、止损点以及退出点。现在,就让我们开始吧!

情景一:

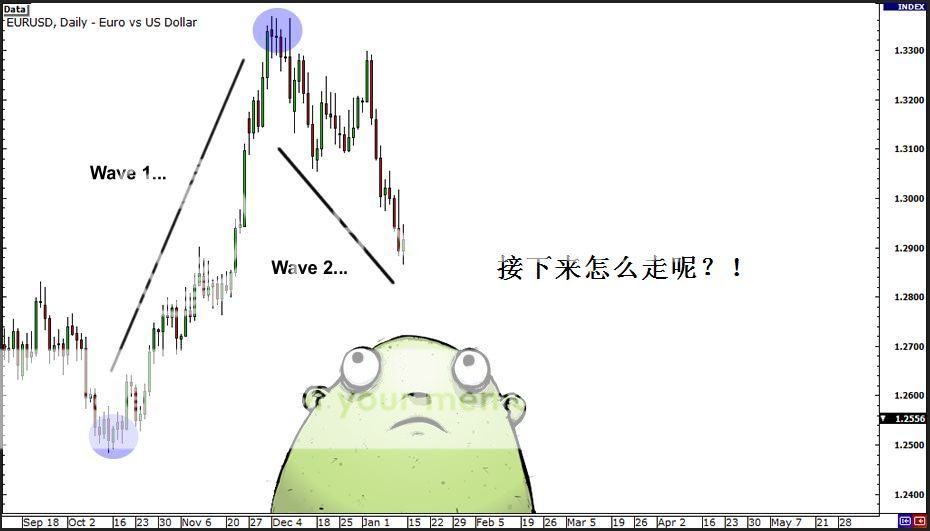

首先,我们需要进行的就是数浪工作。如下图所示,你看到汇价似乎已经筑底,且已经开启一轮新的上升趋势。利用你所掌握的艾略特波浪理论相关知识,你将这一轮升势标为第1浪,并将随后发生的回撤过程标注为第2浪。

为了找到良好的入场位,你再次回顾我们之前讲过的一些要点,以确定自己能够将3条重要原则和指导要点中的哪几点运用进来。在本例中,你会发现:

● 规则二:第2浪永远不可能超过第1浪开启的起点

● 第2浪回撤的幅度最倾向于第1浪的50%或者61.8%

因此,结合斐波那契波浪理论的3条重要原则和指导要点,你决定拿出斐波那契工具,以判断汇价是否处于斐波那契水平位。

你发现,汇价刚好处于50%的斐波那契回撤位水平,嗯,这很可能就是第3浪的开启阶段,因为它已经发出了非常强的买入信号。

作为精明交易者的你,止损点的设置也当然在你的考虑之内。

规则二提到,第2浪永远不可能超过第1浪开启的起点,因此,你选择将止损位设在第1浪开启的起点下方水平。

如果汇价回撤幅度超过第1浪的100%,那么,你所数的浪将是错误的。

让我们看看,接下来发生了什么。。。

你的艾略特波浪理论分析为你带来了丰厚的回报!因为你抓住了一轮相当巨大的上升过程。随后,你来到澳门或拉斯维加斯,在轮盘赌中将之前的获利输个精光,并在此回到开始时的状态。幸运的是,在这里,你还有再一次赚钱的机会…

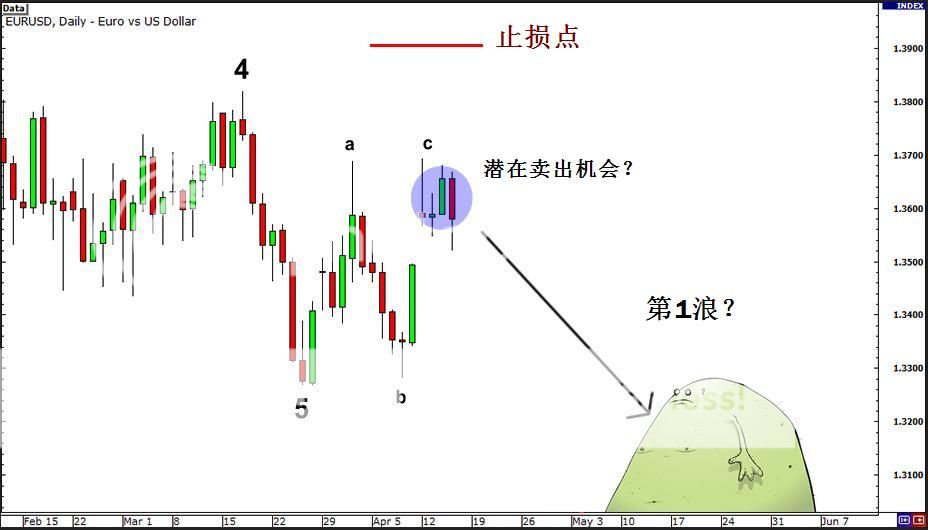

情景二:

这次,让我们看看在下降浪中如何利用波浪形态获利。

你注意到,ABC回调浪正处于横盘整理态势。你会想,这可能是平台形态吗?如果果真如此,则意味着,一旦C浪走势结束,则将开启新一轮的推动浪走势。

怀着对艾略特波浪理论无比崇敬的心情,你选择市价做空欧元/美元,因为你期待能够抓住新一轮推动浪的获利机会。

你将止损位设在第四浪开启点位的上方,以防止你对浪的判断出现失误。

这次,你的判断再次正确。在我们的交易中,把握好的开始只成功了一半,选择完美的出场时机则能够宣告我们交易的成功。这次,你的获利高达将近2000点,当然,这种机会并不会始终出现。

你已经吸取了之前的教训,放弃了去澳门或拉斯维加斯一试身手的想法,转而将你的获利用来充实你的交易账户。

Summary Of Elliott Wave Theory

- Elliott Waves are fractals. Each wave can be split into parts, each of which is a very similar copy of the whole. Mathematicians like to call this property “self-similarity”.

- A trending market moves in a 5-3 wave pattern.

- The first 5-wave pattern is called impulse wave.

- One of the three impulse waves (1, 3, or 5) will always be extended. Wave 3 is usually the extended one.

- The second 3-wave pattern is called corrective wave. Letters A, B, and C are used instead of numbers to track the correction.

- Waves 1, 3 and 5, are made up of a smaller 5-wave impulse pattern while Waves 2 and 4 are made up of smaller 3-wave corrective pattern.

- There are 21 types of corrective patterns but they are just made up of three very simple, easy-to-understand formations.

- The three fundamental corrective wave patterns are zig-zags, flats, and triangles.

There are three cardinal rules in Elliott Wave Theory when labeling waves:

- Rule Number 1: Wave 3 can NEVER be the shortest impulse wave

- Rule Number 2: Wave 2 can NEVER go beyond the start of Wave 1

- Rule Number 3: Wave 4 can NEVER cross in the same price area as Wave 1

If you look hard enough at a chart, you’ll see that the market really does move in waves.

Because the forex market never moves in text book perfect fashion, it will take many, many hours of practice analyzing waves before you start to get comfortable with Elliott waves. Stay diligent and never give up!

总结:艾略特波浪理论

PS:根据艾略特波浪理论,市场处于重复运动中,该形态称为波浪。

● 艾略特波浪所具有的一种重要特性就是其具有分形结构。分形是这么一种结构,它能够细分成更小的部分,

而每一个更小的部分都和其整个结构非常的相似。数学家们将这种属性称作“自相似性”。

● 艾略特认为,市场呈5-3浪形态波动。

● 最初的5浪称为推动浪。

● 上升浪(1、3、5浪)中,总有某一浪是延长浪,通常认为,第3浪为延长浪。

● 最后的3浪称为调整浪,通常用字母来表示。

● 第1、3、5浪都是由更小层级的5浪推动浪形态构成,而第2、4浪则由更小的3浪回调浪形态组成。

● 调整浪形态由简单到复杂,可多达21种,但它们仅仅由三种非常易于掌握的形态组成。

● 三种基本的调整浪形态为:锯齿形、平台形以及三角形。

● 艾略特波浪理论有3条重要规则

● 规则一:第3浪永远不是最短的浪

● 规则二:第2浪永远不可能超过第1浪开启的起点

● 规则三:第4浪永远不会进入第1浪的价格范围

● 如果你对图形进行足够的观察,你将看到市场确实处于波浪运动中。

● 由于市场永远不会出现教科书上所描述的运动态势,因此,我们在熟练掌握艾略特理论进行交易之前,需要做大量的实践和分析。要记住,保持勤勉的学习态度和永不放弃的精神!

Most households have an unsolved Rubiks Cube but you can esily solve it learning a few algorithms.